- Gold value holds on to beneficial properties on Monday after US yields dropped decrease.

- In Europe, the German Far-Proper AfD has gained 20% of votes, although not sufficient to maintain the CDU out of a cushty lead.

- US Greenback Index trades flat after US yields softened additional, opening room for Gold to tick larger.

Gold’s value (XAU/USD) is holding on to intraday beneficial properties on Monday, buying and selling close to $2,947 on the time of writing, supported by a weaker US Greenback (USD) and softer US yields in a response to the current German federal election consequence. Though the far-right get together Different for Germany (AfD) has gained 20% of votes, the Christian Democratic Union of Germany (CDU) is comfy within the lead with 208 seats towards AfD’s 152. US yields dropped off and the CME Federal Reserve (Fed) Futures at the moment are favoring a 25 foundation factors (bps) fee reduce in June, the place final week odds have been fairly for no fee reduce in June.

In the meantime, merchants will watch the US Gross Home Product (GBP) launch for the fourth quarter of 2024 later this week. Given the current slowdown in US exercise and financial knowledge (for instance, the softer Companies Buy Managers Index (PMI) studying on Friday), one other drop in US yields could possibly be triggered, with markets anticipating the Federal Reserve reducing its financial coverage fee to spice up the financial system and demand.

Every day digest market movers: US yields on the transfer

- US Yields drop off additional on Monday, with the US 10-year benchmark fee already down over 3% towards the 4.573% excessive from final week. The CME Fed Futures for June revealed odds for a 25 foundation factors fee reduce overtaking odds for no fee reduce by 46.0% for a fee reduce towards 42.3% for no fee reduce within the June 18th coverage assembly.

- Canada’s Equinox Gold Company sought to amass Calibre Mining in a deal that will worth the mixed firms at $5.4 billion. That is the most recent instance of dealmaking as miners capitalize on report gold costs, Bloomberg studies.

- The US greenback weakened after a number of studies and financial knowledge factors final week revealed that US enterprise exercise slowed and client confidence waned, with expectations for inflation surging and markets pricing in additional fee cuts by the Federal Reserve this 12 months, Bloomberg studies.

- Conservative CDU chief Friedrich Merz emerged because the winner in Sunday’s German federal election. Nevertheless, the outcomes gave his Christian Democrat-led bloc only one clear path to energy, dealing with intense stress to rapidly kind a authorities. Whereas the far-right AfD doubled help to develop into the second-strongest get together with 20.8% of the votes, it fell in need of a blocking minority by itself, the Monetary Occasions studies.

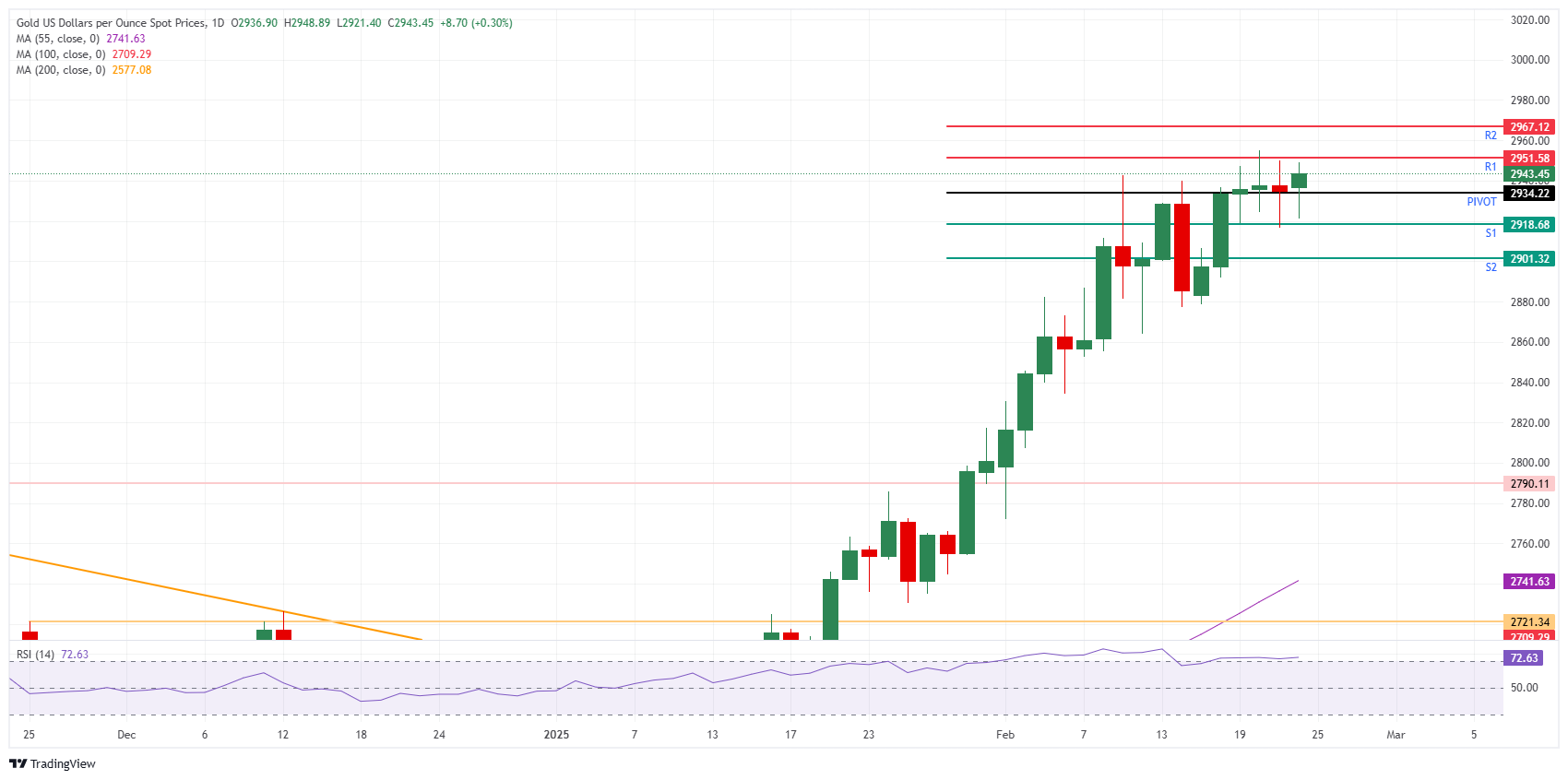

Technical Evaluation: German mud settling

Merchants have to be getting complications from these fixed whipsaw strikes. With increasingly more banks calling for the $3,000 mark, the chance is constructing that the Gold value may not really attain it. The same story was seen within the Euro towards the US Greenback (EUR/USD), the place at one level this 12 months all banks known as for parity, although the pair by no means received there and as an alternative moved larger.

For this Monday, the all-time excessive at $2,955 stays the principle degree to look at. On the best way up, the day by day R1 resistance at $2,951 precedes. Additional up, that means that there shall be a brand new all-time excessive, the R2 resistance stands at $2,967.

On the draw back, help ranges are plentiful, with the day by day Pivot Level at $2,934. Additional down, the S1 help is available in at $2,918, which roughly coincides with Friday’s low. In case that degree doesn’t maintain, the $2,900 massive determine comes into play with the S2 help at $2,901.

XAU/USD: Every day Chart

jyodce

jyodce