- GBP/USD rises sustaining place above the 50-day SMA as market digests US tariff negotiations.

- US labor market exhibits energy with ADP employment figures surpassing expectations, highlight on Nonfarm Payrolls.

- UK financial indicators present slight downturn, with market eyes on BoE’s anticipated price minimize.

The Pound Sterling stays bid for the third consecutive day, edges up 0.34% because the GBP/USD trades at 1.2519 above the 50-day Easy Shifting Common (SMA) at 1.2501.

GBP/USD ascends modestly, bolstered by optimistic market sentiment

The Dollar has erased most of its Monday’s features, spurred by the US imposing tariffs on Mexico and Canada. Nonetheless, each international locations reached agreements with Washington. Due to this fact, traders who as soon as appeared unsure about US commerce insurance policies are assured that US President Donald Trump is utilizing tariffs as a “device” to barter with allies and adversaries.

Knowledge has taken a backseat, with merchants eyeing the discharge of US Nonfarm Payroll figures for January. Wednesday’s US docket featured ADP Nationwide Employment Change for January. The numbers exceeded estimates of 150K and rose by 183K, a sign of energy within the labor market.

On the similar time, enterprise exercise continued to deteriorate. S&P International featured Companies PMI for January, which dipped from 56.8 to 52.9, higher than the 52.8 anticipated. Up subsequent, the Institute for Provide Administration (ISM) will function the Non-Manufacturing PMI, foreseen to extend from 54.1 to 54.3.

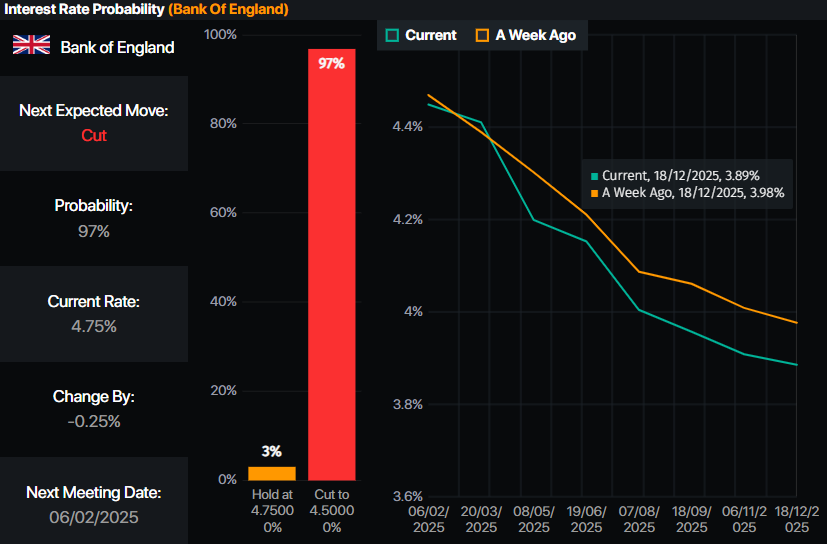

Throughout the pond, January’s UK S&P International Companies PMI dipped from 51.1 to 50.8 as financial circumstances worsened. Merchants await the Financial institution of England’s (BoE) financial coverage choice on Thursday, poised to cut back charges by 25 foundation factors (bps) from 4.75% to 4.50%, in line with Prime Market Terminal information.

Supply: Prime Market Terminal

GBP/USD Worth Forecast: Technical outlook

The GBP/USD cleared the January 27 peak of 1.2523, a powerful resistance stage, and reached a brand new four-week peak at 1.2549. Though bullish, a each day shut above the previous would open the door to problem the year-to-date (YTD) excessive of 1.2575 and the 1.2600 determine.

If there’s a failure to clear 1.2550, sellers could possibly be set to push GBP/USD decrease, with trades eyeing 1.2400. Additional draw back lies beneath the January 2 low of 1.2351, adopted by the February 3 low of 1.2248.

British Pound PRICE As we speak

The desk beneath exhibits the share change of British Pound (GBP) towards listed main currencies at present. British Pound was the strongest towards the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.42% | -0.25% | -1.23% | -0.20% | -0.39% | -0.66% | -0.45% | |

| EUR | 0.42% | 0.19% | -0.78% | 0.22% | 0.03% | -0.25% | -0.02% | |

| GBP | 0.25% | -0.19% | -0.97% | 0.04% | -0.15% | -0.42% | -0.21% | |

| JPY | 1.23% | 0.78% | 0.97% | 1.04% | 0.84% | 0.56% | 0.78% | |

| CAD | 0.20% | -0.22% | -0.04% | -1.04% | -0.19% | -0.45% | -0.25% | |

| AUD | 0.39% | -0.03% | 0.15% | -0.84% | 0.19% | -0.27% | -0.08% | |

| NZD | 0.66% | 0.25% | 0.42% | -0.56% | 0.45% | 0.27% | 0.22% | |

| CHF | 0.45% | 0.02% | 0.21% | -0.78% | 0.25% | 0.08% | -0.22% |

The warmth map exhibits share modifications of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you decide the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will characterize GBP (base)/USD (quote).