Federal Reserve (Fed) Chairman Jerome Powell will testify on the semiannual Financial Coverage Report earlier than the Senate Banking, Housing and City Affairs Committee at 15:00 GMT on Tuesday.

Within the Financial Coverage Report revealed on Friday, February 7, the Fed reiterated that policymakers will weigh incoming information, the evolving outlook and the steadiness of dangers after they contemplate future coverage strikes. Within the meantime, 67 of 101 economists that took half in a recently-conducted Reuters survey mentioned that they anticipate the US central financial institution to decrease the coverage fee by at the very least as soon as by end-June. Based on the CME FedWatch Instrument, markets are at present pricing in a less-than-10% likelihood of the Fed decreasing the coverage fee by 25 foundation factors (bps) in March.

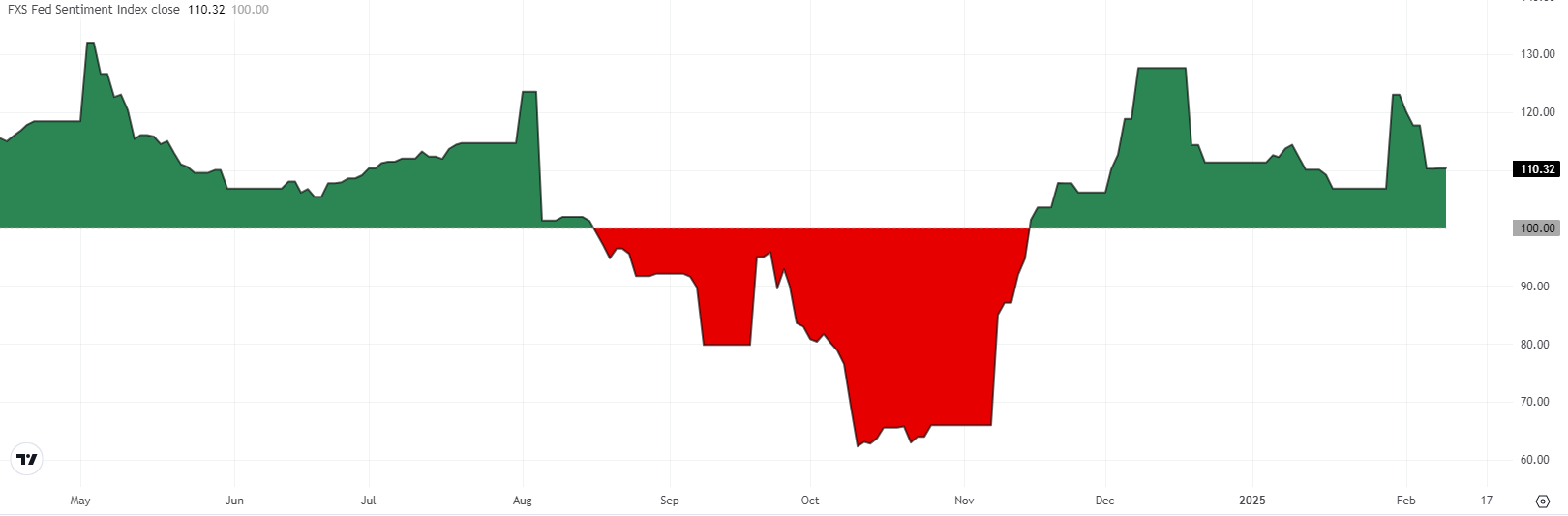

Following the January coverage selections, FXStreet (FXS) Fed Sentiment Index climbed above 120, reflecting a hawkish sentiment. Since then, nevertheless, the Fed Sentiment Index retreated to 110 as some policymakers adopted a comparatively much less hawkish language. Though this decline means that the Fed is softening its tone, it’s but to sign a dovish shift.

In an interview with Bloomberg on Wednesday, February 5, Richmond Fed President Thomas Barkin famous that he was nonetheless leaning in direction of further fee cuts this yr and mentioned that he expects 12-month inflation numbers to “come down properly.” On a extra impartial notice, “the Fed must be aware of overheating and deterioration, however issues are largely going nicely,” Chicago Fed President Austan Goolsbee mentioned and added that he’s hopeful that tariffs find yourself not being a giant obstacle to commerce, primarily based on what they noticed just lately.

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to attain value stability and foster full employment. Its major device to attain these targets is by adjusting rates of interest. When costs are rising too shortly and inflation is above the Fed’s 2% goal, it raises rates of interest, growing borrowing prices all through the economic system. This ends in a stronger US Greenback (USD) because it makes the US a extra enticing place for worldwide traders to park their cash. When inflation falls beneath 2% or the Unemployment Charge is simply too excessive, the Fed could decrease rates of interest to encourage borrowing, which weighs on the Dollar.

The Federal Reserve (Fed) holds eight coverage conferences a yr, the place the Federal Open Market Committee (FOMC) assesses financial situations and makes financial coverage selections. The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve could resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the circulate of credit score in a caught monetary system. It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of alternative throughout the Nice Monetary Disaster in 2008. It entails the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE normally weakens the US Greenback.

Quantitative tightening (QT) is the reverse strategy of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s normally constructive for the worth of the US Greenback.