- The Dow Jones is hitting a snug midrange round 44,450 on Tuesday.

- Threats of nearly-global tariffs have evaporated over 24 hours.

- Commerce tensions stay a difficulty with China, however tariff breaks are priced in.

The Dow Jones Industrial Common (DJIA) is testing the 44,450 area on Tuesday, with equities slowing their latest tempo of volatility as United States (US) President Donald Trump walks again practically all of his latest commerce warfare blustering and kicks his self-imposed tariff can down the highway for a 3rd time. US import tariffs on items from Mexico and Canada have been delayed for as much as 30 days, whereas deliberate tariffs on China are nonetheless on the desk and warnings of tariffs on items from the European Union are additionally within the pipe.

Regardless of all of the commerce warfare bluster, the Trump administration’s three straight walkbacks have left buyers with a robust sense that the tariffs had been by no means meant to be an applied a part of the US’ commerce technique. As a substitute, they had been President Trump’s greatest efforts to work twice as arduous to perform half as a lot, strong-arming a few of America’s closest buying and selling companions to the negotiating desk and acquiring concessions that had been largely already agreed to with the earlier US federal administration. Tariff threats are more likely to be handled much less severely by markets shifting ahead as buyers deal with materials points.

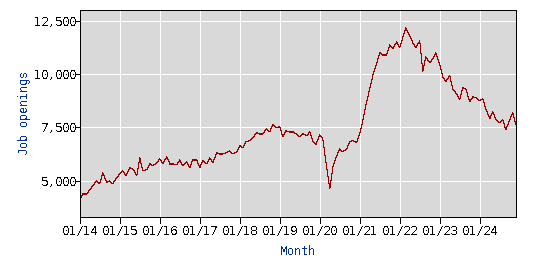

US JOLTS Jobs Openings figures from December printed on Tuesday, displaying a slight cooling to 7.6M from 8.09M. JOLTS has an abysmally low respondent charge of round 30%, and December’s print can be a preliminary determine, due for plenty of revisions all through the calendar 12 months. Regardless, the pattern in patchy job openings information stays clear because the indicator grinds into two-year lows.

Dow Jones information

Over two-thirds of the Dow Jones fairness board is testing into the excessive facet on Tuesday, with investor sentiment dismissing its latest overreaction to commerce warfare gesticulations by the US. Merck & Co tumbled over 10% and fell under $90 per share regardless of topping Wall Road earnings expectations after the drug provider softened its ahead steerage, warning buyers that demand for vaccines in China has not recovered to anticipated ranges and might be pausing additional shipments to mainland China to alleviate a provide buildup.

Dow Jones worth forecast

A back-and-forth tussle on every day candlesticks has the Dow Jones strung alongside a near-term midrange, with worth motion hung up close to the 44,500 degree. Bids discovered a technical flooring close to the 44,000 main worth deal with this week, however topside momentum stays skinny as buyers wrestle to climb over 45,000. An extra cooling interval could also be required as technical oscillators churn in overbought territory.

Dow Jones every day chart

Tariffs FAQs

Tariffs are customs duties levied on sure merchandise imports or a class of merchandise. Tariffs are designed to assist native producers and producers be extra aggressive out there by offering a worth benefit over comparable items that may be imported. Tariffs are extensively used as instruments of protectionism, together with commerce obstacles and import quotas.

Though tariffs and taxes each generate authorities income to fund public items and companies, they’ve a number of distinctions. Tariffs are pay as you go on the port of entry, whereas taxes are paid on the time of buy. Taxes are imposed on particular person taxpayers and companies, whereas tariffs are paid by importers.

There are two faculties of thought amongst economists relating to the utilization of tariffs. Whereas some argue that tariffs are obligatory to guard home industries and handle commerce imbalances, others see them as a dangerous software that might doubtlessly drive costs increased over the long run and result in a dangerous commerce warfare by encouraging tit-for-tat tariffs.

In the course of the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to make use of tariffs to assist the US financial system and American producers. In 2024, Mexico, China and Canada accounted for 42% of complete US imports. On this interval, Mexico stood out as the highest exporter with $466.6 billion, in keeping with the US Census Bureau. Therefore, Trump needs to deal with these three nations when imposing tariffs. He additionally plans to make use of the income generated via tariffs to decrease private earnings taxes.