What is a doji candle, and when does it form and why?

A Complete Guide to Doji Candles Basic to advance is that the Doji candles have a profound effect on trading, be it Forex trading, crypto, or any live trading world based on chart patterns.

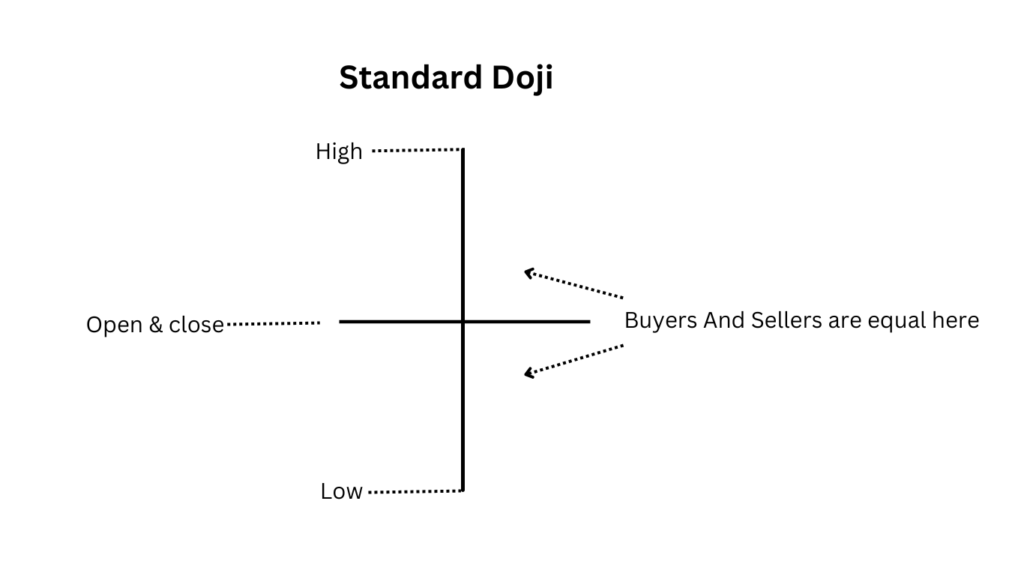

A Doji candle forms when buyers and sellers are equally strong, and neither can take control of the market. And in the end both remain equal, meaning neither buyers can beat sellers nor sellers can beat buyers. The result is that the candle stops at the point where it opens. When a candle appears in the market without a body, we call it a Doji candle and it plays a very important role in the market.

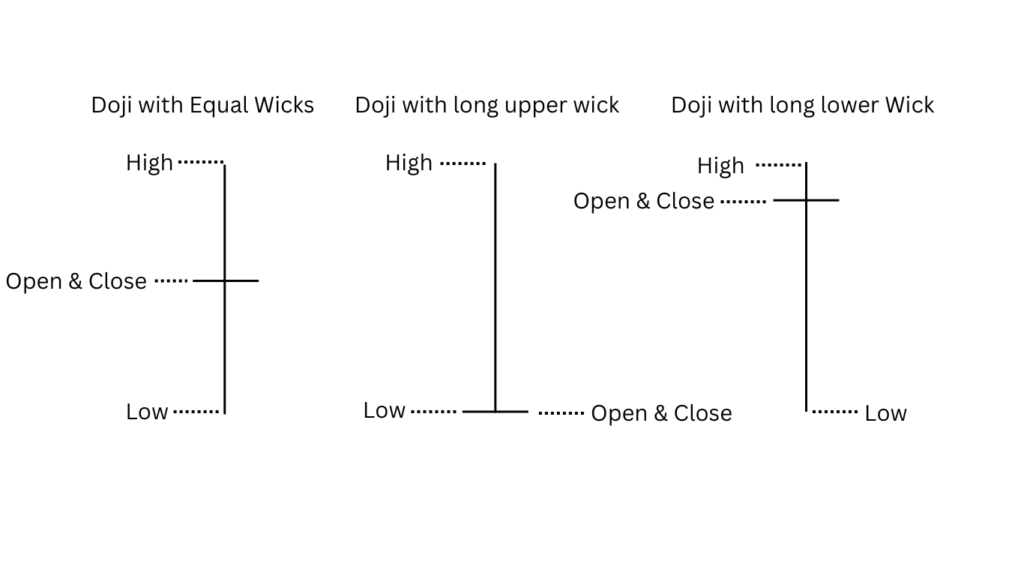

You can see an example of this in the image below. This candle sometimes has wicks(Shadow) from the top and bottom are equal, and sometimes the wick(shadow) is more on the top and less on the bottom. And sometimes the wick(shadow) is more from the bottom and less from the top. These are all doji candles, but they are given different names, which we will explain below.

Types Of Doji Candlestick, how they formed and how to trade on them

Types of Doji candlestick:

- Standard Doji

- Dragonfly Doji

- Gravestone Doji

- Long Legged Doji

Standard Doji:

Explanation:

A candle with an equal top wick and bottom wick is what we call a “standard doji”. It is formed when a candle forms in the market, buyers push the price up at times and sellers push it down at others, but in the end, the market closes at its opening price. This involves both buyers and sellers moving the market up and down equally, and the close is where the candle opened. This tells us that neither the buyers nor the sellers are in control at this point. We also call this candle a “confusion candle” because it is not clear what the market will do next.

Entry Criteria:

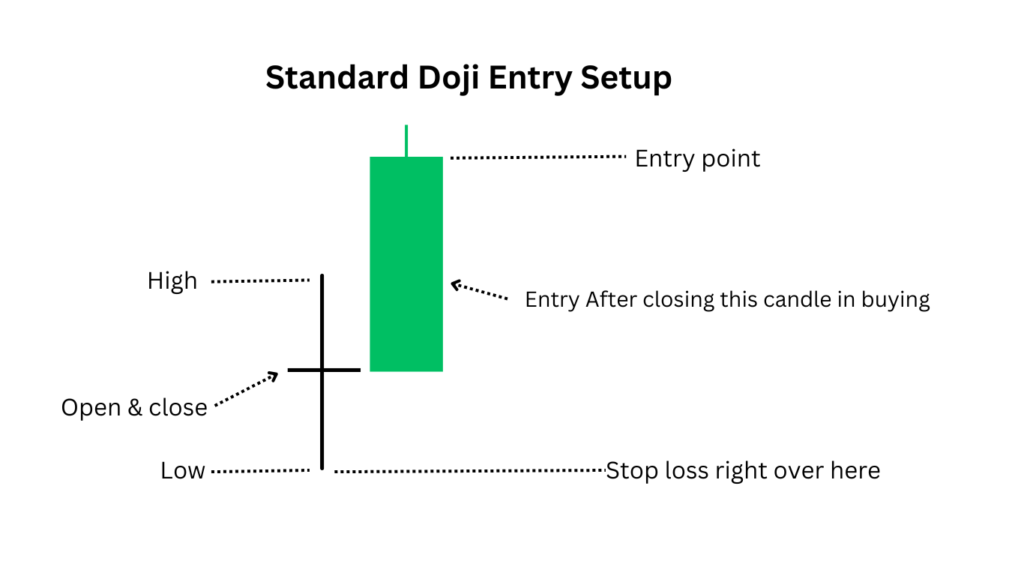

Now we have to see how to get entry on it. After its close, the next candle will decide whether to buy or sell now. If the next candle breaks the high of the standard doji candle and closes above, then we will take an entry. It is very important to wait for the close of the next candle; Never take an entry before the close as this can be a “fake breakout”, in which Smart Money can lure retail traders into a trap and hunt their stop loss.

The market may then go up again, but only after our stop loss is applied. We call this situation a “liquidity swap”. To avoid this, it is important to wait for the close of the candle. As soon as the close occurs, we will enter, and our stop loss will be below the previous doji candle. Take profit will depend on market behaviour and session, but at least we will keep 1:2 ratio. That is, if our stop loss is 1 dollar, the take profit will be 2 dollars.

Important Points:

- Always trade according to the trend, that is, if you see this setup with the trend, then enter.

- Take a trade on this setup when the market stands at support and all these conditions are met.

- If you have a favourite indicator and it also fulfils these conditions, take a trade.

- Most importantly, the accuracy of this setup will be higher the larger the time frame. Generally this setup gives better results on 30 minute, 1 hour, 4 hour, or daily time frame.

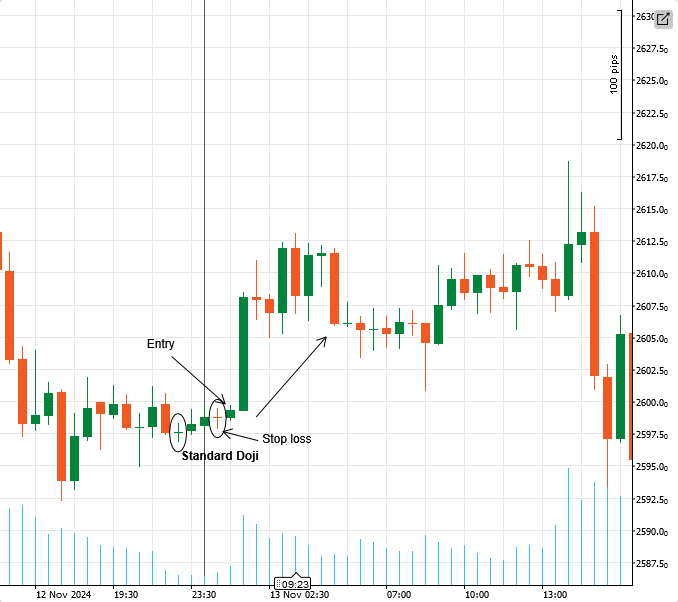

Live Example of Entry Module:

We took entries according to all the rules or setups and they gave us very good targets

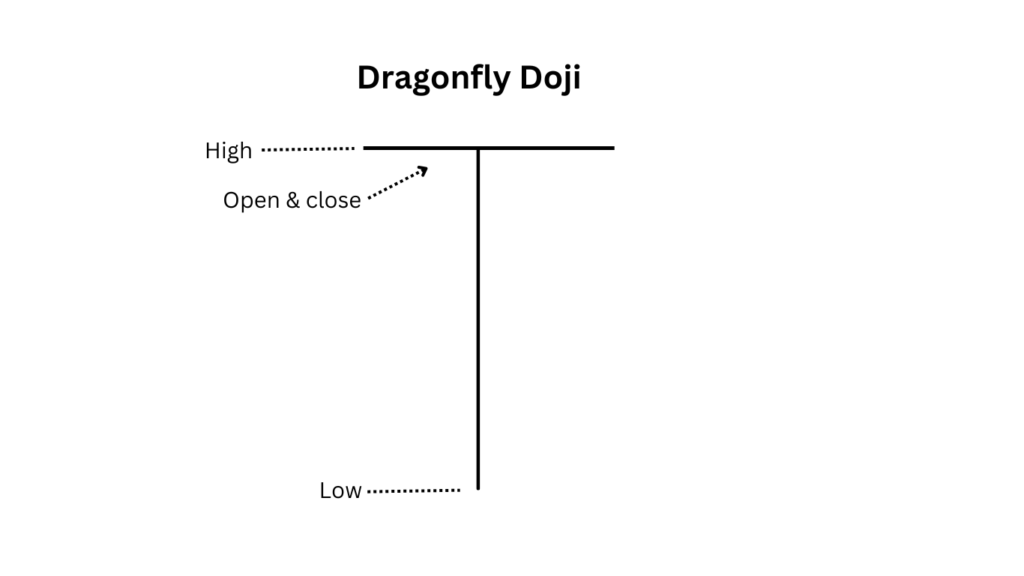

Dragonfly Doji:

Explanation:

A candle that moves lower at the opening and remains lower for the rest of the time, but is under pressure from sellers after completing its time. However, eventually buyer pressure builds and pushes the market higher. After moving up, the candle closes where it opened. This candle has a long wick (shadow) below it, and has the same closing and opening price. We call such a candle a Dragonfly Doji.

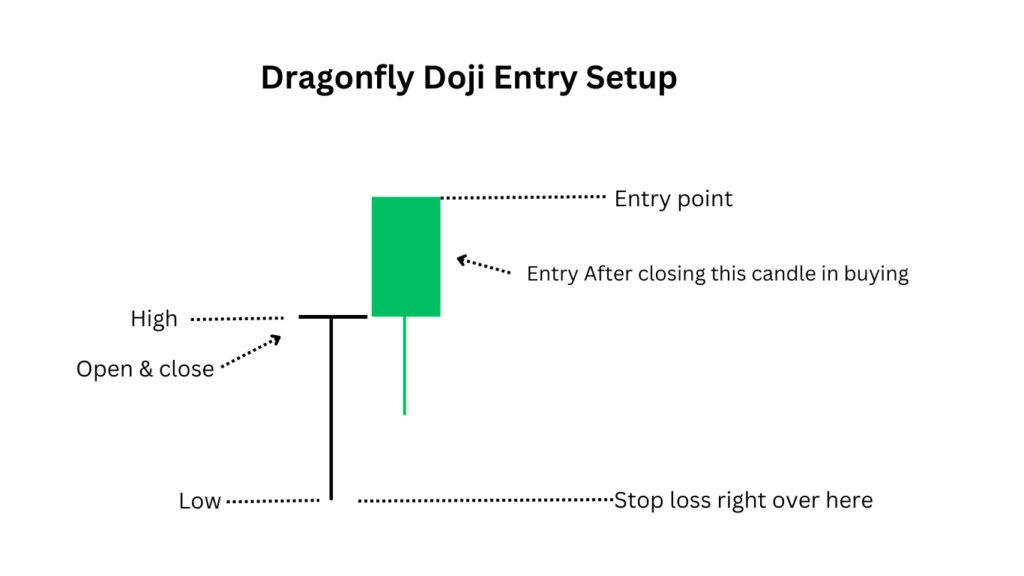

Entry Criteria:

It has the same entry rules as we read above for the standard doji, but with a slight difference. The difference is that after the candle opens, the sellers take it down, but eventually the buyers consolidate and drive the market up. This tells us that buyers were stronger at the close of the candle, which may, but not necessarily, give more attention to that candle.

We will look at all the other rules and plan to buy the correct market if it is at support or buy if the market is in a bullish trend. And will buy even if any indicator is confirmed. But the most important thing is to wait for the close of the next candle to buy with all these rules. And if it is in the market at the resistance, it will follow the confusion candle rule and it can be a reversal signal.

If the next candle closes below after this candle forms at the resistance, we can close immediately. But if there is a trend reversal, we will wait, and if the three candles move up a bit and come down and break the low of the second candle, So we will seal immediately. Our stop will be above the loss doji candle and our minimum target will be 1:2. For buying we will take entry on the closing of the second candle but keeping in mind all the rules. Now from what we see in the picture, this entry is also acceptable, but if you want to take a safer trade, you can wait for the quality of the third candle. Even if you don’t wait for it, you can take entry from it, no problem, but with support and trend.

Imp Tips:

It has all the rest of the tips mentioned in the standard doji above.

- Here are some tips or tricks that are important to know: If on the reversal of the buying trend, after the closing of the new candle, the 3rd candle wick builds up and breaks the low of the 2nd candle, then an entry is to be taken for selling.

- Similarly, if there was a sell trend and now you understand that a reversal is going to happen and this criteria is met, the entry should be taken from the third candle, but its accuracy will be higher.

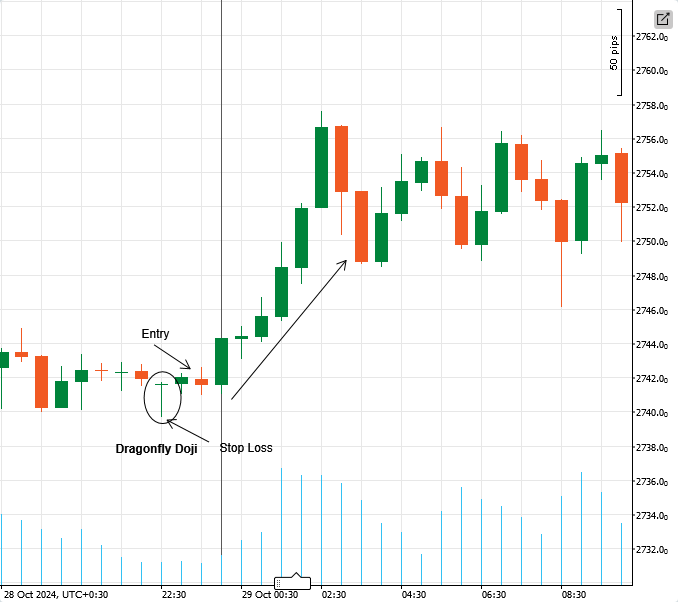

Live Examples:

iThis example has a slight upper wick but it’s negligible, we still think of it as a dragonfly.

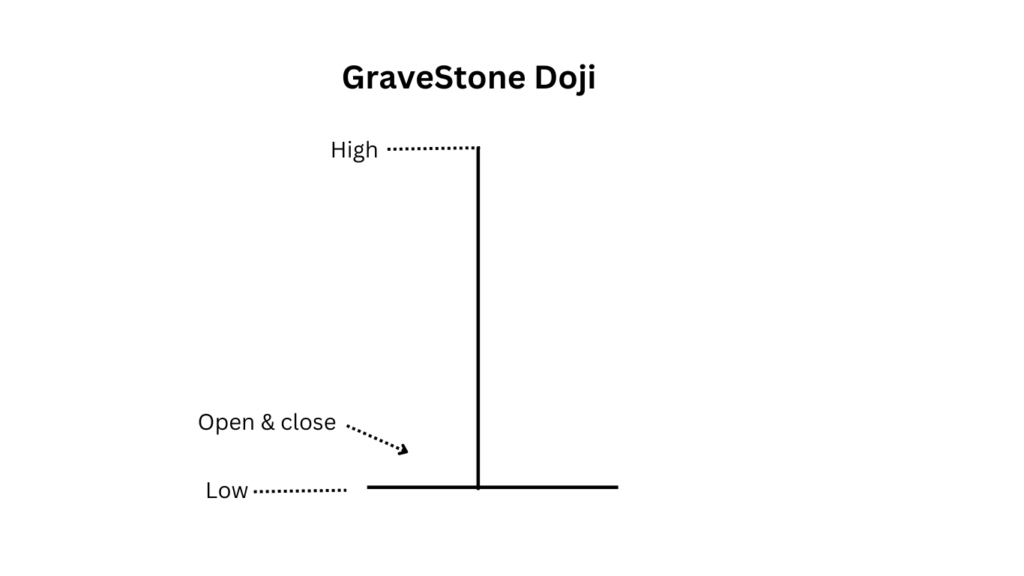

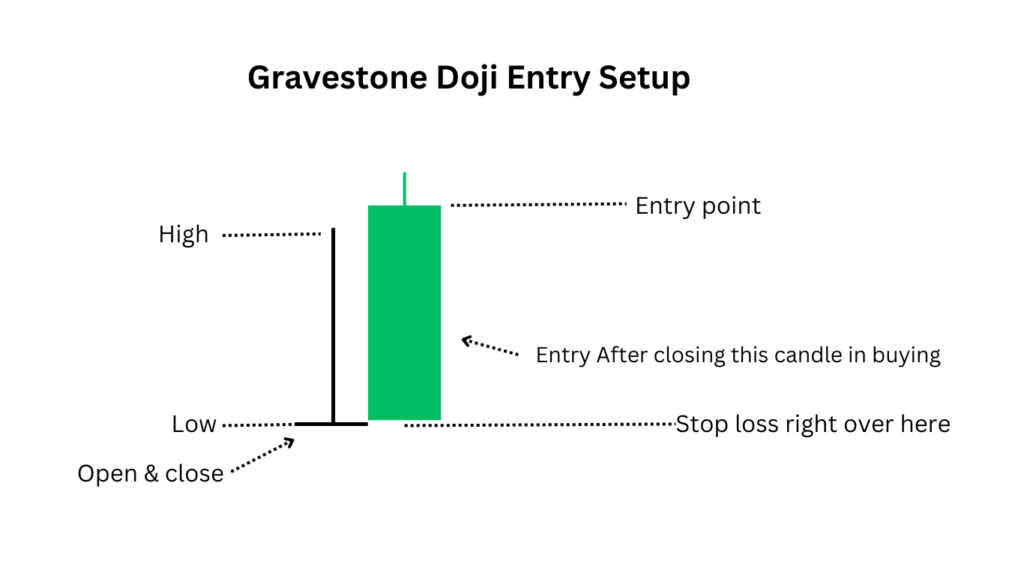

Gravestone Doji:

Explanation:

The Gravestone Doji and the Dragonfly Doji work in reverse. Dragonfly closes to the upside while Gravestone Doji closes the candle to the downside. A candle that immediately goes under the control of the buyers at the opening but is eventually brought down by the closing of the sellers, in this candle the market goes up after the opening but the closing is where it opened, it cannot go down. We call such a candle a Gravestone Doji. Even if the wick is slightly down, it doesn’t matter much. The important thing is that the top wick is long enough and the bottom wick is short enough to be barely visible, so this is not a problem.

Entry Criteria:

Its entry criteria will be the reverse of the Dragonfly Doji. The rules are that if the support, trend or any of our favourite indicators are being completed or the setup is being completed, we will execute the trade, be it selling or buying.

The closing of the next candle is necessary. In selling, it will be more effective to sell from resistance, especially when the third candle has formed an upper wick and there is a low break of the third candle, then it will be more likely to execute the trade. Similarly, we will also take trades with support and trend continuation, but this will require full confirmation. Also with the indicator will wait for all the setup to complete. You will understand this in the example. Now from what we see in the picture, this entry is also valid, but if you want to take a safer trade, you can wait for the quality of the third candle. Even if you don’t wait for it, you can take entry from it, no problem, but with support and trend.

live Example:

IN this example, you can see how much higher the accuracy is than the resistance.

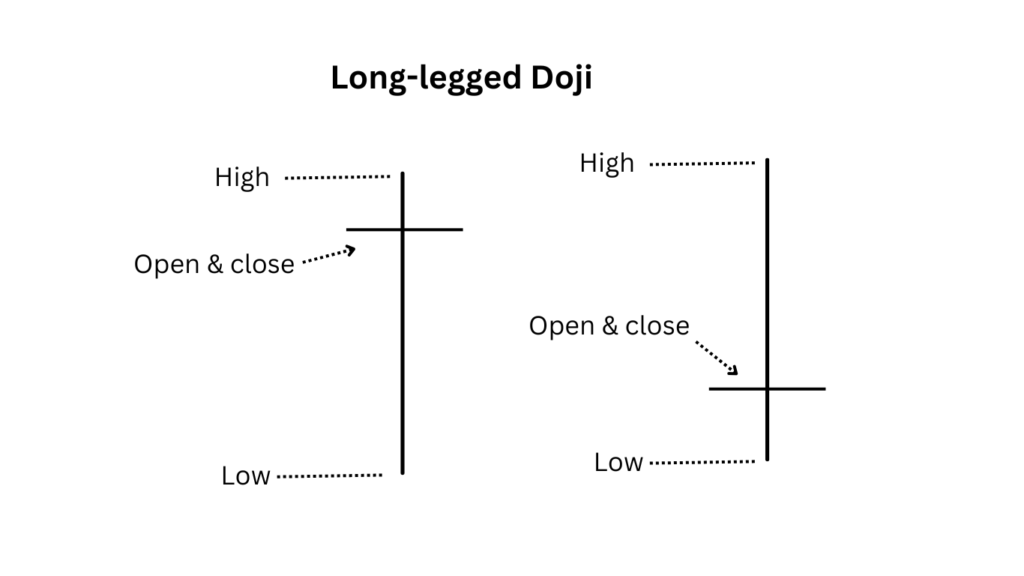

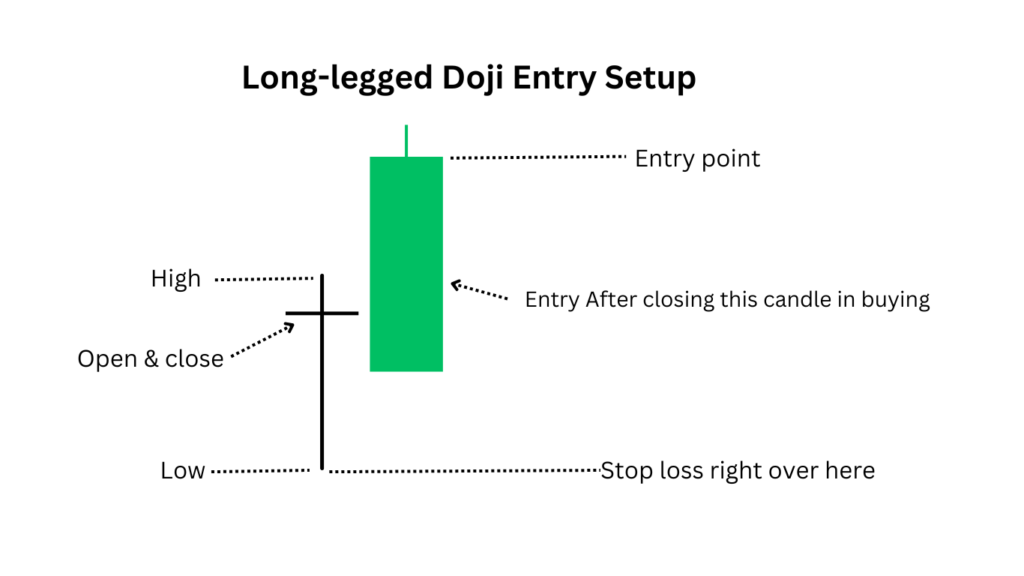

Long legged Doji (Long-tail Doji)

Explanation:

A long-legged doji is a candle that has a very long wick (shadow) on one side and a short wick on the other side. This candle shows the uncertainty of the market, where there is conflict between both sellers and buyers.

Entry Criteria:

When a long-legged doji candle forms near support or resistance, it is evaluated. Entry is planned keeping in view the current market trend. If the market is in a bullish trend and the long-legged doji’s wick is down, it can be a buy signal.

Similarly, if the market is in a bearish trend and the candle’s wick is up, it may signal a sell. It is always important to wait for the close of the next candle for confirmation so that an entry decision can be made correctly.

If the long-legged doji’s wick is up and then the market moves down, it can be a sell signal, provided the market is in a bearish trend. The entry of this candle is decided according to the current market trend and support or resistance levels.

Live Example:

Conclusion:

All types of Doji candles indicate uncertainty or a possible reversal in the market. Entry on these candles is always taken as per full verification and rules. Confirmation of support or resistance, the current trend, and any indicators is essential before taking an entry. The decision is made by waiting for the close of the next candle to make the entry safer and more effective. Whether buying or selling, all setups must be completed to increase the chances of trade success.