- The ADP Employment Change report is seen exhibiting a deceleration of job creation within the US personal sector in November.

- The ADP report might anticipate the extra related Nonfarm Payrolls report on Friday.

- The US Greenback seems to increase its constructive begin to the week.

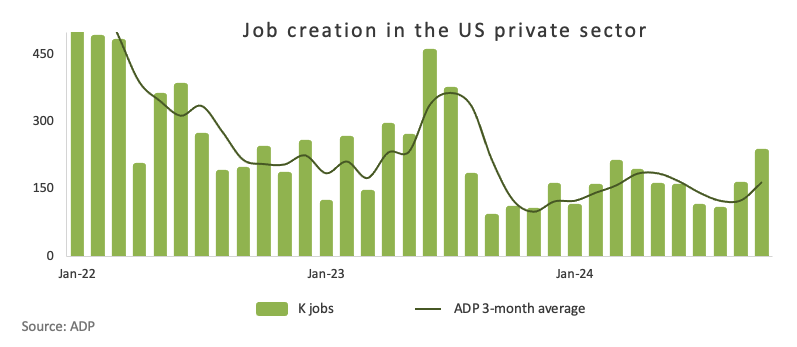

The ADP Analysis Institute is about to publish its month-to-month replace on private-sector job development for November on Wednesday. Referred to as the ADP Employment Change report, it’s anticipated to point out that US employers added 150K jobs final month, down from 233K in October.

Usually launched two days earlier than the official Nonfarm Payrolls (NFP) report, the ADP information is usually considered as an early preview of the Bureau of Labor Statistics (BLS) jobs report. Nevertheless, the connection between the 2 has confirmed to be considerably inconsistent over time. For instance, whereas ADP confirmed a 233K acquire in October, the official quantity reported by the BLS was a meager 12K.

Employment development and its position in shaping Fed coverage

US employment information has taken centre stage in figuring out financial coverage selections because the Federal Reserve’s (Fed) Chief Jerome Powell and different fee setters prompt that inflation has been convincingly trending in the direction of the central financial institution’s 2.0% goal.

The Fed has been strolling a tightrope within the post-pandemic economic system, striving to steadiness its twin mandate: most employment and worth stability. Confronted with hovering inflation in 2022, the Fed responded by mountaineering rates of interest to historic highs in a bid to chill the economic system and convey costs beneath management.

The labour market performed an important position on this equation. Tight job situations risked including extra gas to the inflation fireplace, however current months have seen indicators of a more healthy financial steadiness. This shift allowed the Fed to regulate its technique. At its September assembly, it shocked markets with a 50 basis-point (bps) fee reduce and hinted that extra reductions could possibly be on the horizon.

True to this steering, the Fed applied a further 25 bps fee reduce at its November 7 assembly. Following this transfer, Chair Powell emphasised that the Fed is in no rush to proceed chopping charges, signalling a possible pause in December. This hawkish shift led to a big discount in market expectations for additional cuts on the December 18 gathering.

Fed officers, together with Powell, have repeatedly described the US economic system as being “in place.”

The CME Group’s FedWatch Device at present reveals a greater than 75% probability of a quarter-point fee reduce later this month.

Nevertheless, upcoming employment information might affect these odds. A stronger-than-expected ADP Employment Change report would possibly help the case for holding charges regular, bolstering the US Greenback (USD) by sustaining the Fed’s restrictive stance. Conversely, a weaker report might revive hypothesis about one other fee reduce, doubtlessly difficult the Dollar’s current energy.

Even so, any response to the ADP report could also be fleeting. Buyers are prone to await Friday’s Nonfarm Payrolls (NFP) report, which historically offers a extra complete view of the labour market, earlier than making important strikes.

When will the ADP Report be launched, and the way might it have an effect on the USD Index?

The ADP Employment Change report for November will probably be launched on Wednesday at 13:15 GMT. It’s anticipated to point out that the US personal sector added 150K new jobs through the month.

As markets await the report, the US Greenback Index (DXY) is trying to consolidate a really auspicious begin to the week, bouncing off final week’s lows close to 105.60 and briefly reclaiming the 106.70 area to this point.

From a technical perspective, Pablo Piovano, Senior Analyst at FXStreet, says: “The US Greenback Index (DXY) continues its regular climb, with the following main goal being the current cycle excessive simply above the 108.00 degree on November 22. Past that, it goals for the November 2022 prime of 113.14 (November 3)”.

“On the draw back, any pullback would first encounter help on the weekly low of 105.61 (November 29), seconded by the essential 200-day SMA, at present at 104.04, and the November low of 103.37 (November 5). Additional declines might check the 55-day and 100-day SMAs at 103.95 and 103.29, respectively. A deeper retreat would possibly even convey the index nearer to its 2024 backside of 100.15, recorded on September 27”, Pablo provides.

Lastly, Pablo concludes: “The Relative Power Index (RSI) on the weekly chart hovers across the 58 area and factors upwards. On the similar time, the Common Directional Index (ADX) has misplaced some momentum, receding beneath 44 however nonetheless indicative of a strong uptrend”.

Employment FAQs

Labor market situations are a key ingredient to evaluate the well being of an economic system and thus a key driver for forex valuation. Excessive employment, or low unemployment, has constructive implications for client spending and thus financial development, boosting the worth of the native forex. Furthermore, a really tight labor market – a state of affairs in which there’s a scarcity of employees to fill open positions – also can have implications on inflation ranges and thus financial coverage as low labor provide and excessive demand results in increased wages.

The tempo at which salaries are rising in an economic system is vital for policymakers. Excessive wage development signifies that households have more cash to spend, often main to cost will increase in client items. In distinction to extra risky sources of inflation akin to vitality costs, wage development is seen as a key part of underlying and persisting inflation as wage will increase are unlikely to be undone. Central banks all over the world pay shut consideration to wage development information when deciding on financial coverage.

The load that every central financial institution assigns to labor market situations is determined by its goals. Some central banks explicitly have mandates associated to the labor market past controlling inflation ranges. The US Federal Reserve (Fed), for instance, has the twin mandate of selling most employment and secure costs. In the meantime, the European Central Financial institution’s (ECB) sole mandate is to maintain inflation beneath management. Nonetheless, and regardless of no matter mandates they’ve, labor market situations are an necessary issue for policymakers given its significance as a gauge of the well being of the economic system and their direct relationship to inflation.

Financial Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment within the personal sector launched by the most important payroll processor within the US, Computerized Information Processing Inc. It measures the change within the variety of folks privately employed within the US. Usually talking, an increase within the indicator has constructive implications for client spending and is stimulative of financial development. So a excessive studying is historically seen as bullish for the US Greenback (USD), whereas a low studying is seen as bearish.

Learn extra.

Subsequent launch: Wed Dec 04, 2024 13:15

Frequency: Month-to-month

Consensus: 150K

Earlier: 233K

Supply: ADP Analysis Institute