- The Canadian Greenback shed one other 0.4% in opposition to the Dollar on Tuesday.

- Canada noticed a steeper-than-expected contraction in headline CPI inflation figures.

- Underlying drivers in Canadian inflation throw warning indicators for shopper spending.

The Canadian Greenback (CAD) plunged to a contemporary multi-year low on Tuesday, falling four-tenths of a % in opposition to the Dollar and pushing USD/CAD to its highest bids in almost 5 years, sending the pair above 1.4300 for the primary time since March of 2020. Annualized Canadian Client Value Index (CPI) inflation figures disillusioned markets, delivering a muddle image of Canadian worth progress on either side of the equation.

Regardless of headline Canadian CPI easing under the two% mark on a yearly foundation, month-to-month inflation figures seem to stay caught. Core CPI inflation additionally stays sticky, trending north of two.7% YoY, although the Financial institution of Canada’s (BoC) personal measure of core CPI is continuous to float decrease.

Each day digest market movers: Canadian Greenback drops additional after CPI print misses the mark

- Headline Canadian CPI inflation got here in at 1.9% YoY, under the anticipated maintain at 2.0%.

- The BoC’s in-house CPI Core metric grew by 1.6% YoY, under the earlier 1.7%.

- The general backslide in principal Canadian CPI figures will assist to bolster expectations of one other charge minimize from the BoC in January, regardless of BoC Governor Tiff Macklem’s latest warnings that the tempo of BoC charge cuts shall be “extra gradual” from right here on out.

- Underlying core inflation stays sticky regardless of the drops in headline figures; whereas the BoC expects core inflation to common 2.3% within the fourth quarter, it’s presently drifting close to 2.7%.

- Mortgage curiosity prices eased in November, serving to to melt CPI metrics, although underlying hire costs accelerated one other 7.7% over the identical interval.

- As a lot as Canadians welcomed reductions on electronics and guided tour journey prices round Black Friday, one other 2.6% annualized improve in grocery prices nonetheless bites into wallets as Canadians battle to exchange meals with tv units.

Canadian Greenback worth forecast

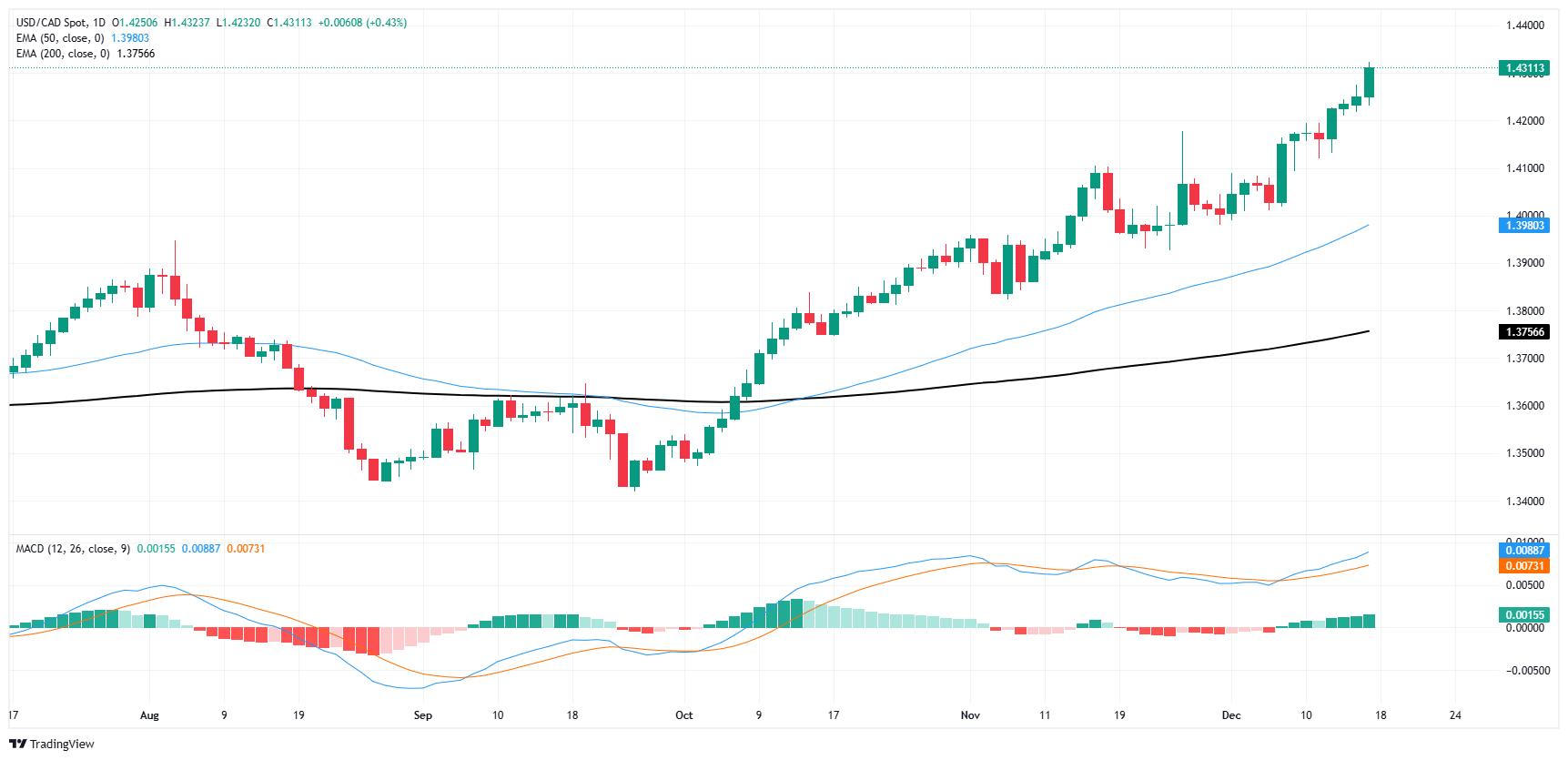

The Canadian Greenback has shed over 2.2% in opposition to the US Greenback in December alone and is on tempo to finish decrease in opposition to the Dollar for a fourth straight month. Because the Loonie continues to deflate in opposition to the USD, USD/CAD costs have rallied again above the 1.4300 deal with, a bottom-to-top rise of almost 7% from September’s backside bids close to 1.3420.

USD/CAD has moved steadily north in a one-sided medium-term development, and the 50-day Exponential Shifting Common (EMA) has struggled to maintain up with worth motion as the important thing shifting common rises into 1.3400. As Dollar bidders continues to pummel the Loonie, USD/CAD bids are headed to highs not seen for the reason that top of the COVID pandemic above 1.4600.

USD/CAD day by day chart

Canadian Greenback FAQs

The important thing components driving the Canadian Greenback (CAD) are the extent of rates of interest set by the Financial institution of Canada (BoC), the worth of Oil, Canada’s largest export, the well being of its financial system, inflation and the Commerce Stability, which is the distinction between the worth of Canada’s exports versus its imports. Different components embrace market sentiment – whether or not traders are taking up extra dangerous property (risk-on) or in search of safe-havens (risk-off) – with risk-on being CAD-positive. As its largest buying and selling associate, the well being of the US financial system can be a key issue influencing the Canadian Greenback.

The Financial institution of Canada (BoC) has a major affect on the Canadian Greenback by setting the extent of rates of interest that banks can lend to at least one one other. This influences the extent of rates of interest for everybody. The primary objective of the BoC is to keep up inflation at 1-3% by adjusting rates of interest up or down. Comparatively larger rates of interest are usually constructive for the CAD. The Financial institution of Canada may also use quantitative easing and tightening to affect credit score circumstances, with the previous CAD-negative and the latter CAD-positive.

The value of Oil is a key issue impacting the worth of the Canadian Greenback. Petroleum is Canada’s largest export, so Oil worth tends to have a direct affect on the CAD worth. Typically, if Oil worth rises CAD additionally goes up, as mixture demand for the forex will increase. The other is the case if the worth of Oil falls. Larger Oil costs additionally are inclined to end in a higher probability of a constructive Commerce Stability, which can be supportive of the CAD.

Whereas inflation had at all times historically been regarded as a damaging issue for a forex because it lowers the worth of cash, the other has truly been the case in fashionable instances with the relief of cross-border capital controls. Larger inflation tends to guide central banks to place up rates of interest which attracts extra capital inflows from international traders in search of a profitable place to maintain their cash. This will increase demand for the native forex, which in Canada’s case is the Canadian Greenback.

Macroeconomic information releases gauge the well being of the financial system and may have an effect on the Canadian Greenback. Indicators akin to GDP, Manufacturing and Providers PMIs, employment, and shopper sentiment surveys can all affect the path of the CAD. A powerful financial system is nice for the Canadian Greenback. Not solely does it entice extra overseas funding however it might encourage the Financial institution of Canada to place up rates of interest, resulting in a stronger forex. If financial information is weak, nonetheless, the CAD is more likely to fall.