- The Pound Sterling extends its upside to close 1.2600 aagainst the US Greenback after weak US Retail Gross sales information for January.

- A delay in imposition of reciprocal tariffs by US President Trump has weighed on the US Greenback.

- Buyers await the UK labor market and inflation information for contemporary cues on BoE’s coverage outlook subsequent week.

The Pound Sterling (GBP) posts a contemporary eight-week excessive round 1.2600 in opposition to the US Greenback (USD) in Friday’s North American session. The GBP/USD pair strengthens because the US Greenback slumps after the discharge of the US (US) Retail Gross sales information for January.

The Census Bureau reported that Retail Gross sales, a key measure of shopper spending, declined at a faster-than-expected tempo of 0.9% on month after increasing by 0.7% in December, upwardly revised from 0.4%. On the 12 months, the buyer spending measure rose by 4.2%, slower than the 4.4% growth in December, upwardly revised from 3.9%.

Weak Retail Gross sales information is prone to power merchants to make contemporary Federal Reserve (Fed) dovish bets. At present, the Fed is anticipated to maintain rates of interest regular within the subsequent three coverage conferences, based on the CME FedWatch software. Whereas there’s an virtually 50% likelihood that the Fed can minimize rates of interest within the July assembly.

After poor Retail Gross sales information, the US Greenback Index (DXY), which tracks the Dollar’s worth in opposition to six main currencies, extends its draw back to close 106.75, the bottom stage seen in virtually 4 weeks.

The US Greenback was already underperforming since President Donald Trump directed the Commerce Division and commerce representatives to plot a plan to match tariffs on every product with each nation.

President Trump stated within the Oval Workplace on Thursday, “I’ve determined for functions of equity that I’ll cost a reciprocal tariff.” Trump added, “It is truthful to all, no different nation can complain.” The President additional added that tariffs will “stage the enjoying discipline for all US firms.”

This state of affairs weighed closely on the US Greenback, as market contributors anticipated that Trump would impose reciprocal tariffs instantly. These assumptions have been primarily based on his tweet at Reality Social, “Three nice weeks, maybe the most effective ever, however in the present day is the massive one: reciprocal tariffs!!! Make America nice once more!!!”, which got here in early North American buying and selling hours on Thursday.

Every day digest market movers: Pound Sterling trades distinctively with friends forward of UK employment and inflation information

- The Pound Sterling reveals a combined efficiency in opposition to its main friends on Friday. The British foreign money struggles as buyers shift focus to the labor market information for the three months ending December and the Client Worth Index (CPI) information for January, which might be launched on Tuesday and Wednesday, respectively. Each financial indicators will affect market hypothesis about whether or not the Financial institution of England (BoE) will scale back rates of interest once more within the March assembly. The BoE minimize its key borrowing charges by 25 foundation factors (bps) to 4.5% on February 6.

- The British foreign money has been performing cautiously as buyers are involved about the UK’s (UK) financial outlook regardless of upbeat Gross Home Product (GDP) information for December and the final quarter of the earlier 12 months.

- Within the newest financial coverage assembly, the BoE halved its GDP forecasts for the 12 months to 0.75%, which was a giant blow for Chancellor of the Exchequer Rachel Reeves, who has been promising to carry financial development. The BoE acknowledged that greater international tariffs would decelerate their development fee.

- The UK Workplace for Nationwide Statistics (ONS) reported on Thursday that the economic system surprisingly expanded by 0.1% within the fourth quarter of 2024, whereas economists projected it to have contracted at the same tempo. In December, the GDP development fee was strong at 0.4%.

British Pound PRICE Right now

The desk beneath exhibits the share change of British Pound (GBP) in opposition to listed main currencies in the present day. British Pound was the strongest in opposition to the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.30% | -0.37% | -0.38% | -0.18% | -0.56% | -0.73% | -0.43% | |

| EUR | 0.30% | -0.07% | -0.10% | 0.11% | -0.26% | -0.43% | -0.13% | |

| GBP | 0.37% | 0.07% | 0.00% | 0.18% | -0.19% | -0.36% | -0.05% | |

| JPY | 0.38% | 0.10% | 0.00% | 0.18% | -0.20% | -0.36% | -0.06% | |

| CAD | 0.18% | -0.11% | -0.18% | -0.18% | -0.40% | -0.53% | -0.24% | |

| AUD | 0.56% | 0.26% | 0.19% | 0.20% | 0.40% | -0.17% | 0.13% | |

| NZD | 0.73% | 0.43% | 0.36% | 0.36% | 0.53% | 0.17% | 0.30% | |

| CHF | 0.43% | 0.13% | 0.05% | 0.06% | 0.24% | -0.13% | -0.30% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in case you decide the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will symbolize GBP (base)/USD (quote).

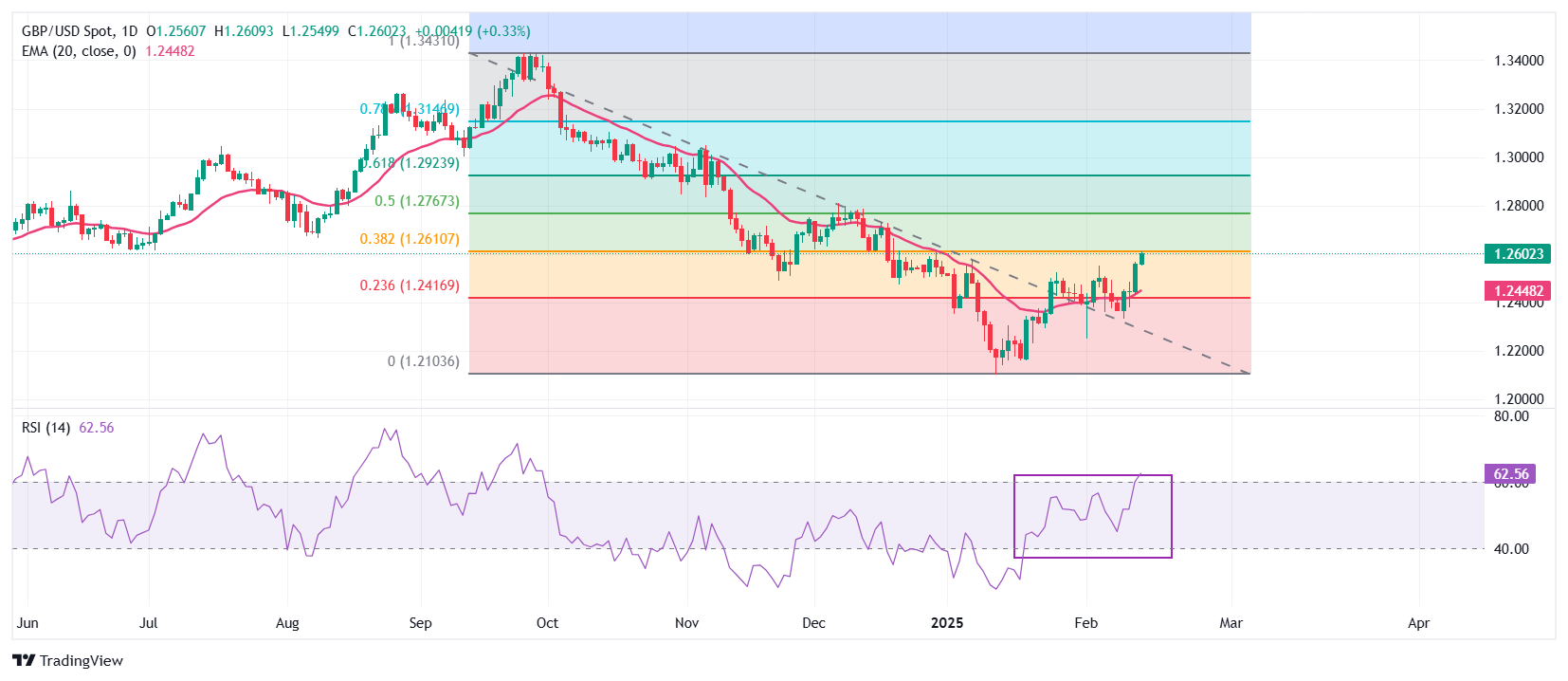

Technical Evaluation: Pound Sterling jumps to close 1.2600

The Pound Sterling refreshes eight-week excessive round 1.2600 in opposition to the US Greenback in North American buying and selling hours on Friday. The GBP/USD pair strengthened after breaking above the February 5 excessive of 1.2550. The outlook of the Cable has turned bullish because the 20-day Exponential Transferring Common (EMA) begins sloping greater, which stands round 1.2448.

The 14-day Relative Power Index (RSI) advances to close 60.00. A bullish momentum would activate if the RSI (14) sustains above that stage.

Trying down, the February 3 low of 1.2250 will act as a key help zone for the pair. On the upside, the 50% Fibonacci retracement at 1.2767 will act as a key resistance zone.

Financial Indicator

Retail Gross sales (MoM)

The Retail Gross sales information, launched by the US Census Bureau on a month-to-month foundation, measures the worth in whole receipts of retail and meals shops in the US. Month-to-month % modifications mirror the speed of modifications in such gross sales. A stratified random sampling methodology is used to pick roughly 4,800 retail and meals providers corporations whose gross sales are then weighted and benchmarked to symbolize the whole universe of over three million retail and meals providers corporations throughout the nation. The information is adjusted for seasonal differences in addition to vacation and trading-day variations, however not for value modifications. Retail Gross sales information is broadly adopted as an indicator of shopper spending, which is a serious driver of the US economic system. Usually, a excessive studying is seen as bullish for the US Greenback (USD), whereas a low studying is seen as bearish.

Learn extra.

Final launch: Fri Feb 14, 2025 13:30

Frequency: Month-to-month

Precise: -0.9%

Consensus: -0.1%

Earlier: 0.4%

Supply: US Census Bureau