- GBP/USD hits a each day low of 1.2374 as US inflation jumps above 3%.

- The US Greenback strengthens as buyers count on Fed’s first charge lower till September 2025.

- If GBP/USD prints a each day shut beneath 1.2400, sellers would goal 1.2300.

The Pound Sterling slipped throughout the North American session after the newest United States (US) inflation report confirmed that costs continued to rise, pushing again expectations of a Federal Reserve charge lower within the first half of 2025. The GBP/USD trades at 1.2387, down 0.47%.

Pound dips as US inflation surges

Inflation reaccelerates within the US, because the US Bureau of Labor Statistics (BLS) reveals. The Client Value Index (CPI) rose above 3% YoY for the primary time since June 2024. Month-over-month (MoM) figures jumped 0.5%, up from December’s 0.4%. Within the meantime, excluding unstable objects, CPI elevated by 3.3% YoY from 3.2%, and MoM expanded by 0.4%, up from 0.2%, exceeding estimates of 0.3%.

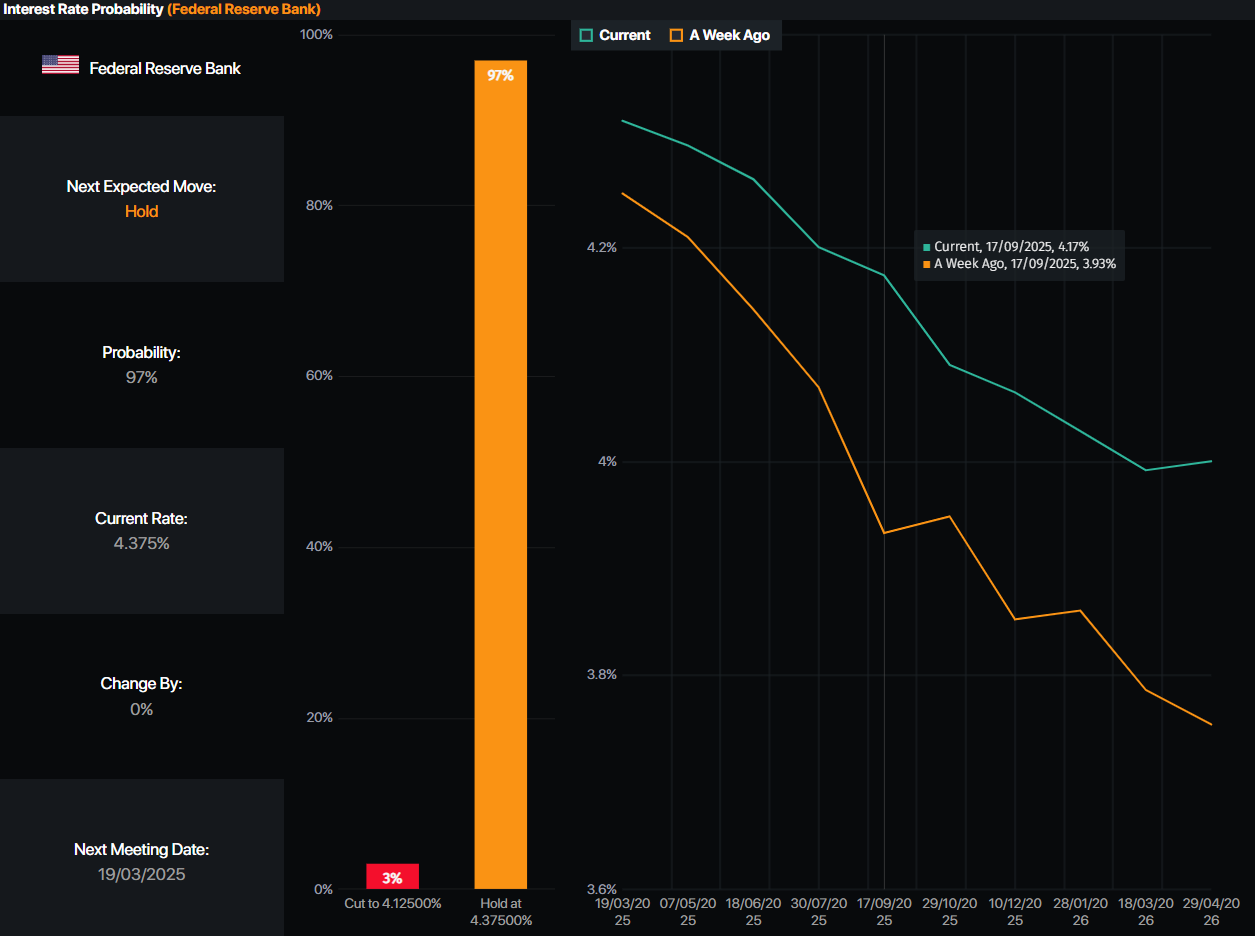

After the info, buyers count on the primary charge lower till September, based on knowledge from Prime Market Terminal. The swaps market had priced in 20 foundation factors of easing towards the September 17 assembly, down from final week’s 45 bps.

Supply: Prime Market Terminal

Within the UK, the Nationwide Institute of Financial and Social Analysis (NIESR) predicts the Financial institution of England (BoE) has little room to chop charges additional and predicts the BoE will lower charges as soon as in 2025 and once more in 2026.

This week, merchants are eyeing Fed Chair Jerome Powell’s testimony on the US Home of Representatives. In addition to him, Atlanta’s Fed Bostic and Governor Waller would cross the wires.

Within the UK, the docket will function Gross Home Product (GDP) figures for This fall 2024. Economists count on the economic system to contract by -0.1% QoQ, but on an annual foundation, they estimate development of 1.1%, up from Q3’s 0.9%.

GBP/USD Value Forecast: Technical outlook

GBP/USD worth motion signifies the pair stays tilted to the draw back however is ready to consolidate inside the 1.2330 – 1.2450 space. The Relative Energy Index (RSI) means that momentum stays bearish, opening the door for additional promoting strain within the pair.

A each day shut beneath 1.2400 might sponsor a leg towards the February 11 low of 1.2332, adopted by the February 3 low of 1.2248. On additional weak point, 1.22000 is up subsequent. Conversely, if GBP/USD rises previous 1.2400 and challenges the 50-day Easy Transferring Common (SMA) at 1.2475, the change charge might goal in direction of 1.2500.

British Pound PRICE As we speak

The desk beneath reveals the proportion change of British Pound (GBP) in opposition to listed main currencies right this moment. British Pound was the strongest in opposition to the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.40% | 1.24% | 0.25% | 0.68% | 0.69% | 0.14% | |

| EUR | -0.16% | 0.24% | 1.07% | 0.09% | 0.52% | 0.52% | -0.02% | |

| GBP | -0.40% | -0.24% | 0.80% | -0.14% | 0.28% | 0.29% | -0.26% | |

| JPY | -1.24% | -1.07% | -0.80% | -0.97% | -0.54% | -0.54% | -1.07% | |

| CAD | -0.25% | -0.09% | 0.14% | 0.97% | 0.43% | 0.43% | -0.11% | |

| AUD | -0.68% | -0.52% | -0.28% | 0.54% | -0.43% | 0.00% | -0.54% | |

| NZD | -0.69% | -0.52% | -0.29% | 0.54% | -0.43% | -0.00% | -0.54% | |

| CHF | -0.14% | 0.02% | 0.26% | 1.07% | 0.11% | 0.54% | 0.54% |

The warmth map reveals proportion adjustments of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you choose the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will symbolize GBP (base)/USD (quote).