- USD/JPY rebounds 0.35% from 151.64 low, pushed by bond yield actions.

- Technical evaluation hints at bullish shift; resistance close to 200-day SMA at 152.76.

- Draw back dangers if SMA not surpassed; helps at 152.00 and 150.93 in focus.

The USD/JPY climbed through the North American session. It trades at 152.52 and posts positive aspects of over 0.35% after hitting a day by day low of 151.64. The rise of the US 10-year T-note bond yield spurred the rise of the pair, which is positively correlated to the yield of the 10-year.

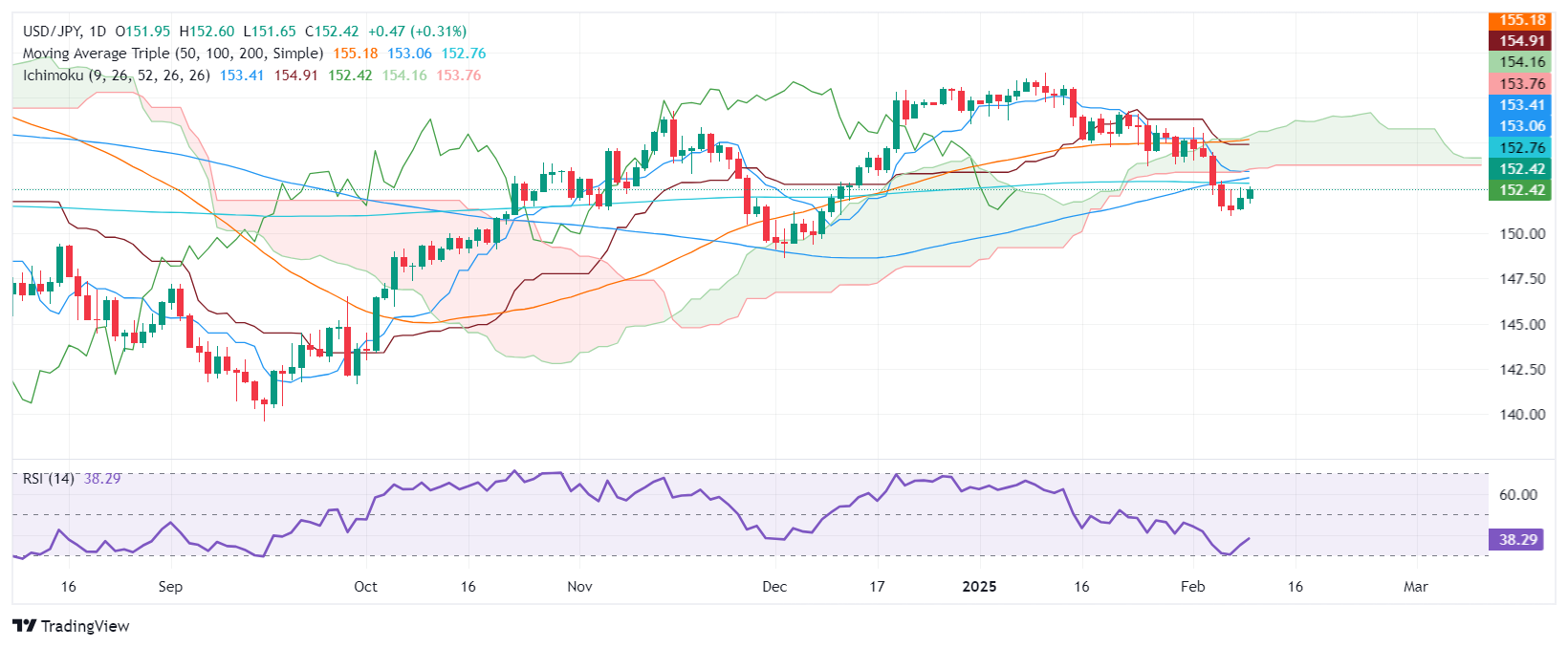

USD/JPY Worth Forecast: Technical outlook

The USD/JPY stays biased downward, despite the fact that patrons might problem the 200-day Easy Transferring Common (SMA) at 152.76. The momentum shifted barely bullish despite the fact that the relative power index (RSI) stays bearish, and the slope goals upwards.

If patrons regain the 200-day SMA, the next key resistance can be the 153.00 mark earlier than testing the Senkou Span B base at 153.76.

Alternatively, if USD/JPY stays beneath the 200-day SMA, the primary assist can be the 152.00 determine. Additional losses lie beneath the February 7 day by day low of 150.93, adopted by the December 3 swing low of 148.64.

USD/JPY Worth Chart – Each day

Japanese Yen PRICE Right this moment

The desk beneath reveals the share change of Japanese Yen (JPY) towards listed main currencies right now. Japanese Yen was the strongest towards the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.53% | -0.60% | 0.30% | -0.16% | -0.28% | -0.23% | 0.16% | |

| EUR | 0.53% | -0.08% | 0.85% | 0.39% | 0.25% | 0.30% | 0.70% | |

| GBP | 0.60% | 0.08% | 0.93% | 0.46% | 0.31% | 0.36% | 0.76% | |

| JPY | -0.30% | -0.85% | -0.93% | -0.45% | -0.59% | -0.53% | -0.14% | |

| CAD | 0.16% | -0.39% | -0.46% | 0.45% | -0.13% | -0.08% | 0.31% | |

| AUD | 0.28% | -0.25% | -0.31% | 0.59% | 0.13% | 0.05% | 0.44% | |

| NZD | 0.23% | -0.30% | -0.36% | 0.53% | 0.08% | -0.05% | 0.39% | |

| CHF | -0.16% | -0.70% | -0.76% | 0.14% | -0.31% | -0.44% | -0.39% |

The warmth map reveals share adjustments of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you decide the Japanese Yen from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify JPY (base)/USD (quote).