- Gold hits an all-time excessive of $2,845, gaining over 1% as commerce warfare fears intensify safe-haven demand.

- Chinese language retaliatory tariffs on US items and export controls amplify market uncertainties.

- Upcoming Fed speeches might affect gold’s trajectory, with potential hawkish shifts tempering positive aspects.

Gold reached a document excessive of $2,845 late Tuesday in the course of the North American session because the US Greenback tumbled, weighed down by falling US Treasury bond yields. The “commerce warfare” between the US (US) and China sparked a flight to the yellow steel’s safe-haven standing. The XAU/USD trades at $2,843, up greater than 1%.

Geopolitical points are driving bullion costs. Though US President Donald Trump delayed tariffs on Mexico and Canada, duties of 10% on Chinese language items kicked in, sparking retaliatory actions by China.

China utilized tariffs on particular merchandise, corresponding to coal, Liquefied Pure Gasoline (LNG), Crude Oil, farm tools and electrical vans imported from the US. Moreover, it has determined to impose controls on exports of some metals, that are vital for electronics.

The escalation of the US-China commerce warfare weighed on the Dollar, which, in response to the US Greenback Index (DXY), fell 0.43%, beneath the 108.00 determine.

Subsequently, the non-yielding steel is ready to increase its rally, initially in the direction of $2,850, forward of the $2,900 determine.

Nonetheless, Federal Reserve (Fed) audio system might cap Gold’s advance in the event that they develop into barely hawkish. San Francisco Fed President Mary Daly stated the Fed’s job isn’t performed on inflation, including that the US financial system is in an excellent place and the Central Financial institution is in a robust place to attend and see and assess tariffs’ impression.

Each day digest market movers: Bullion costs underpinned by falling US yields

- Gold worth soars underpinned by falling US yields. US actual yields, as measured by the 10-year Treasury Inflation-Protected Securities (TIPS), tumble virtually six foundation factors (bps) down from 2.13% to 2.072%

- The US 10-year Treasury bond yield falls 4 bps to 4.51%.

- US Jobs Openings and Labor Turnover Survey (JOLTS) information confirmed that job openings are lowering, indicating a robust labor market. Job openings plunged to 7.6 million in December, revealing that the Division of Labor had decreased from November 8.156 million and was beneath forecasts of 8 million.

- US Manufacturing unit Orders fell -0.9% in December, beneath forecasts of a -0.7% contraction.

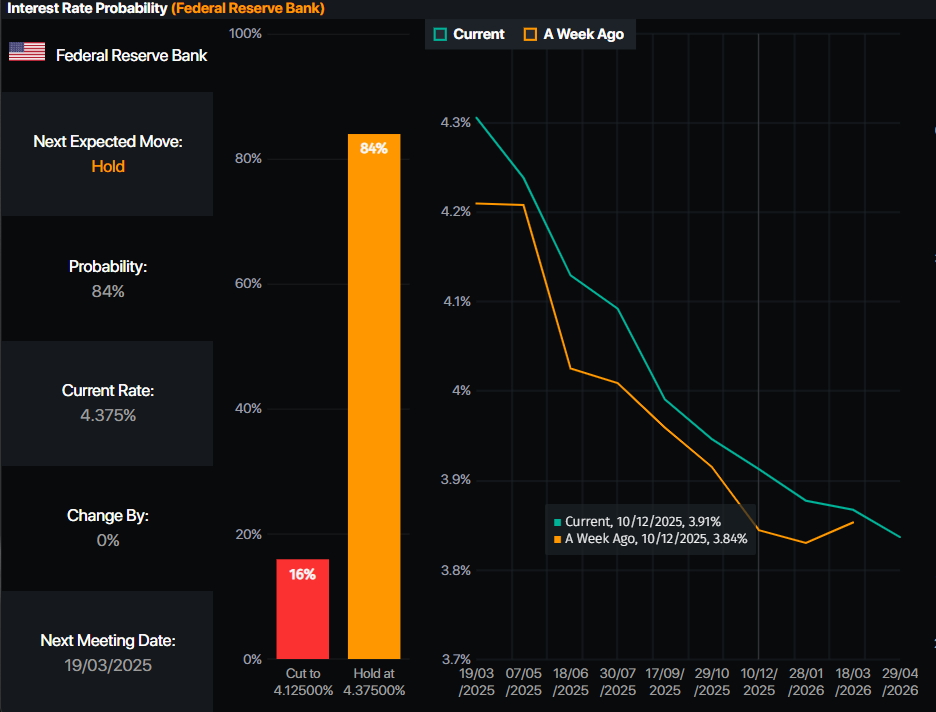

- Cash market fed funds charge futures are pricing in 48 foundation factors (bps) of easing by the Federal Reserve in 2025.

Supply: Prime Market Terminal

XAU/USD technical outlook: Gold costs set to hit document highs

Gold’s uptrend stays intact as bullish momentum grows, as depicted by the Relative Energy Index (RSI). The RSI offers overbought alerts, however as a result of pattern’s power, essentially the most excessive degree strikes up from 70 to 80. Subsequently, because the RSI is at 74, bulls might stay hopeful that increased costs lie forward.

The following resistance can be $2,850 forward of the 161.8% Fibonacci (Fib) extension at $2,889, forward of $2,900 as seen on the 4-hour chart.

Conversely, if sellers clear the 50-period Easy Transferring Common (SMA) at $2,780, this shall be adopted by the January 27 swing low of $2,730. The following cease beneath there can be $2,700.

Tariffs FAQs

Tariffs are customs duties levied on sure merchandise imports or a class of merchandise. Tariffs are designed to assist native producers and producers be extra aggressive out there by offering a worth benefit over comparable items that may be imported. Tariffs are extensively used as instruments of protectionism, together with commerce boundaries and import quotas.

Though tariffs and taxes each generate authorities income to fund public items and companies, they’ve a number of distinctions. Tariffs are pay as you go on the port of entry, whereas taxes are paid on the time of buy. Taxes are imposed on particular person taxpayers and companies, whereas tariffs are paid by importers.

There are two colleges of thought amongst economists relating to the utilization of tariffs. Whereas some argue that tariffs are mandatory to guard home industries and tackle commerce imbalances, others see them as a dangerous device that might doubtlessly drive costs increased over the long run and result in a dangerous commerce warfare by encouraging tit-for-tat tariffs.

Throughout the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to make use of tariffs to help the US financial system and American producers. In 2024, Mexico, China and Canada accounted for 42% of whole US imports. On this interval, Mexico stood out as the highest exporter with $466.6 billion, in response to the US Census Bureau. Therefore, Trump desires to deal with these three nations when imposing tariffs. He additionally plans to make use of the income generated by means of tariffs to decrease private earnings taxes.