- The US Greenback trades softer, unsure the place to go subsequent.

- Tariff headlines create fog and uncertainties on the place to go subsequent for markets.

- The US Greenback Index (DXY) holds floor above 108.00 whereas in search of course amidst all these tariff headlines.

The US Greenback Index (DXY), which tracks the efficiency of the US Greenback in opposition to six main currencies, gears up for Tuesday’s knowledge launch after first hitting 109.00 earlier than falling again to the decrease 108.37 stage in European buying and selling. The DXY trades round 108.30 on the time of writing. Markets are reacting to a combination of headlines with a sigh of reduction from Mexico and Canada, which noticed the imposition of US tariffs delayed. In the meantime, China has retaliated in opposition to US President Trump’s tariffs by issuing its personal levies over US imported items.

The financial knowledge calendar is taking its form within the runup in the direction of Friday’s Nonfarm Payrolls knowledge. The US JOLTS Job Openings report will likely be launched later within the day and will give extra insights into the tightness of the labor market. As well as, two Federal Reserve (Fed) audio system, Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly, will communicate and may go away feedback for markets to contemplate.

Every day digest market movers: JOLTS forward

- China has introduced this Tuesday a 15% levy on lower than $5 billion in US power imports, akin to Coal and Liquified Pure Gasoline (LNG), and a ten% charge on American Oil and agricultural tools, and it’ll additionally examine Google for alleged antitrust violations, Bloomberg experiences. In the meantime, Canada and Mexico are seeing US-imposed tariffs being delayed due to their actions to adjust to US President Donald Trump.

- At 15:00 GMT, the month-to-month Manufacturing unit Orders for December are due. Expectations are for an extra decline of -0.7% from -0.4% within the earlier month.

- On the identical time, the TechnoMetrica Institute of Coverage and Politics (TIPP) will launch its month-to-month Financial Optimism studying for February. The consensus is for an uptick to 53, coming from 51.9.

- The US JOLTS Job Openings for December will likely be launched as properly. A small lower to eight million job openings is anticipated, down from 8.098 million in November.

- The Federal Reserve has two audio system lined up as properly:

- Atlanta Fed President Raphael Bostic moderates a dialog with Atlanta Mayor Andre Dickens at a Nationwide Housing Disaster Job Power assembly at Atlanta at 16:00 GMT.

- San Francisco Fed President Mary Daly will take part within the Walter E. Hoadley Annual Financial Forecast panel, hosted by the Commonwealth Membership World Affairs of California at 19:00 GMT.

- Equities are blended with some minor positive aspects and losses in each European indices and US futures.

- The CME FedWatch device initiatives an 86.5% likelihood of holding rates of interest unchanged within the Fed’s subsequent assembly on March 19.

- The US 10-year yield is buying and selling round 4.567%, up from its contemporary yearly low at 4.46% seen Monday.

US Greenback Index Technical Evaluation: Clouded judgement

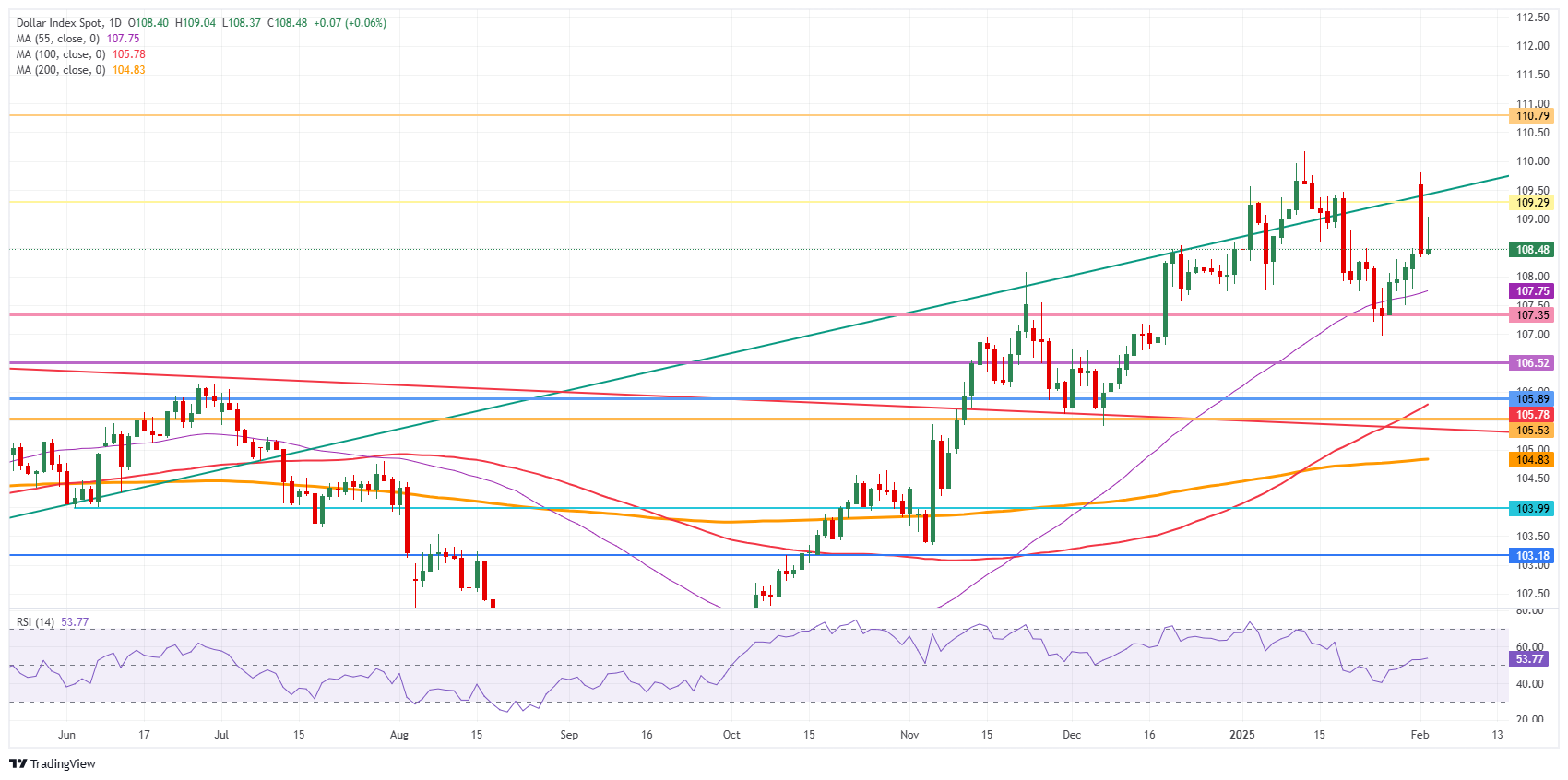

The US Greenback Index (DXY) is everywhere, although zooming out, really going nowhere. A spread is outlined as 107.00 on the draw back and 110.00 on the upside. Anticipate to see the DXY holding vary buying and selling between these two greater ranges for now.

On the upside, the primary barrier at 109.30 (July 14, 2022, excessive and rising trendline) was briefly surpassed however didn’t maintain on Monday. As soon as that stage is reclaimed, the subsequent stage to hit earlier than advancing additional stays at 110.79 (September 7, 2022, excessive).

On the draw back, the 55-day Easy Shifting Common (SMA) at 107.75 and the October 3, 2023, excessive at 107.35 acts as a double assist to the DXY worth. For now, that appears to be holding, although the Relative Power Index (RSI) nonetheless has some room for the draw back. Therefore, search for 106.52 and even 105.89 as higher ranges.

US Greenback Index: Every day Chart

US Greenback FAQs

The US Greenback (USD) is the official foreign money of america of America, and the ‘de facto’ foreign money of a big variety of different international locations the place it’s present in circulation alongside native notes. It’s the most closely traded foreign money on the earth, accounting for over 88% of all world international change turnover, or a median of $6.6 trillion in transactions per day, in line with knowledge from 2022. Following the second world struggle, the USD took over from the British Pound because the world’s reserve foreign money. For many of its historical past, the US Greenback was backed by Gold, till the Bretton Woods Settlement in 1971 when the Gold Normal went away.

Crucial single issue impacting on the worth of the US Greenback is financial coverage, which is formed by the Federal Reserve (Fed). The Fed has two mandates: to attain worth stability (management inflation) and foster full employment. Its main device to attain these two targets is by adjusting rates of interest. When costs are rising too rapidly and inflation is above the Fed’s 2% goal, the Fed will elevate charges, which helps the USD worth. When inflation falls under 2% or the Unemployment Price is just too excessive, the Fed might decrease rates of interest, which weighs on the Dollar.

In excessive conditions, the Federal Reserve also can print extra {Dollars} and enact quantitative easing (QE). QE is the method by which the Fed considerably will increase the movement of credit score in a caught monetary system. It’s a non-standard coverage measure used when credit score has dried up as a result of banks is not going to lend to one another (out of the worry of counterparty default). It’s a final resort when merely decreasing rates of interest is unlikely to attain the required consequence. It was the Fed’s weapon of option to fight the credit score crunch that occurred throughout the Nice Monetary Disaster in 2008. It includes the Fed printing extra {Dollars} and utilizing them to purchase US authorities bonds predominantly from monetary establishments. QE normally results in a weaker US Greenback.

Quantitative tightening (QT) is the reverse course of whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing in new purchases. It’s normally optimistic for the US Greenback.