- USD/JPY declines from highs of 155.86, settling at 154.51 amid tariff-induced volatility.

- ISM Manufacturing PMI rises, signaling strong enterprise exercise regardless of international commerce fears.

- Financial institution of Japan maintains optimistic outlook, able to navigate Trump’s protectionist insurance policies.

The USD/JPY retreated from each day highs of 155.86 hit after US President Donald Trump superior on its protectionist insurance policies, enacting tariffs in Canada, Mexico, and China. Initially, the Dollar rose, however as fears light, the pair dipped beneath its opening value by 0.44% and traded at 154.51.

Yen strengthens after preliminary drop as Trump’s new tariffs unsettle markets

Market contributors appear nervous, as portrayed by international equities buying and selling within the purple. US President Trump utilized 25% tariffs on Canada and Mexico and 10% to China. US-North American companions vowed retaliatory measures, whereas the latter, would problem this coverage on the World Commerce Group (WTO).

On the time of writing, the ISM Manufacturing PMI for January elevated by 50.9, exceeding forecasts of 49.8. It was up from December 49.2, a sign of enchancment in enterprise exercise. Digging deeper into the information, the sub-component of costs paid superior from 52.5 to 54.9, whereas the employment index improved from 45.4 in December to 50.3.

Within the meantime, throughout the Asian session, the Financial institution of Japan revealed its January assembly Abstract of Opinions. A few of the members added that inflation expectations are heightening as costs rise above the two% inflation goal, and others stated that mountain climbing charges could be sufficiently impartial. Policymakers acknowledged that Japan’s economic system is resilient and may navigate via protectionist insurance policies carried out by Trump.

This week, the US financial docket will characteristic Fed audio system, JOLTS Job Orders information, and Manufacturing facility Orders on February 4. In Japan, the schedule is mild with the Jibun Financial institution Providers PMI last launch for January.

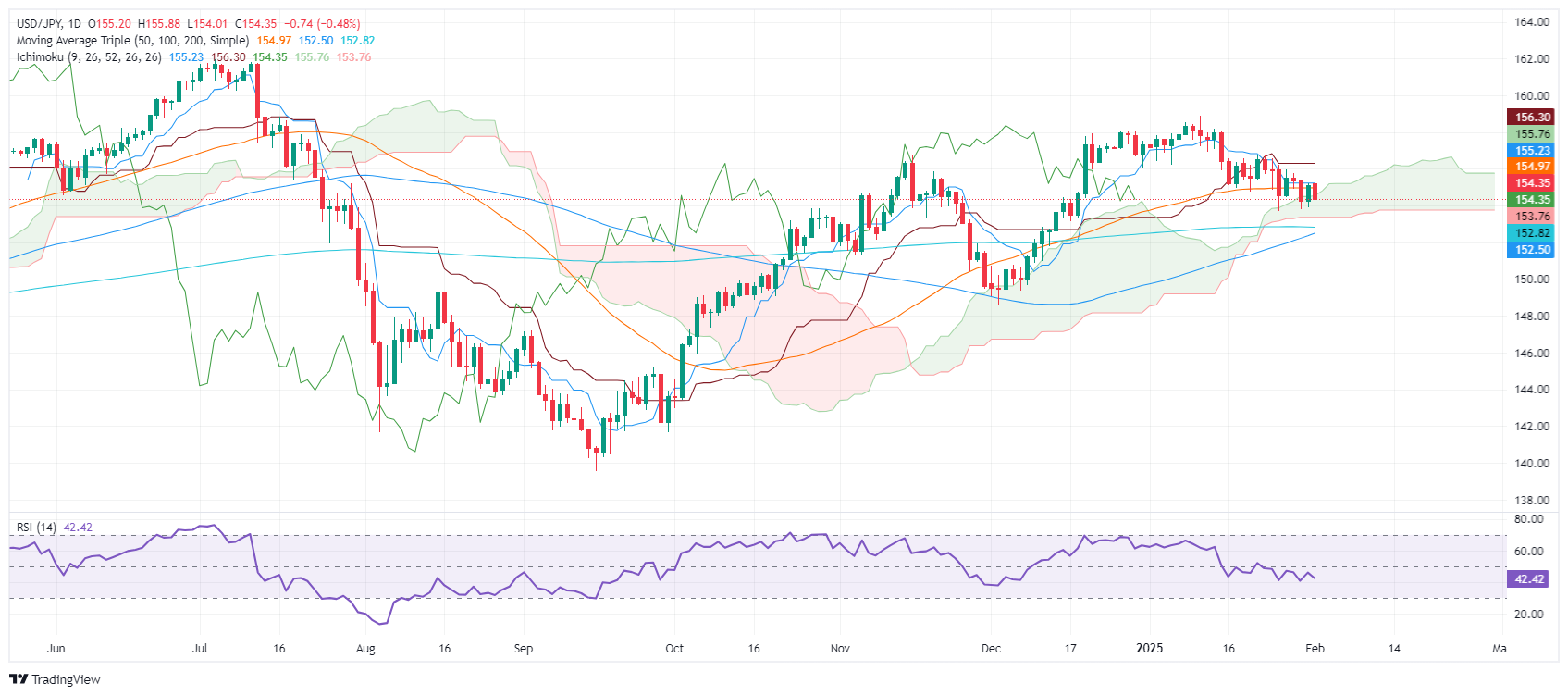

USD/JPY Worth Evaluation: Technical outlook

The USD/JPY is forming a ‘bearish candle’ with a protracted higher shadow, a sign that the pair will not be discovering acceptance throughout the 154.78-155.88 vary. That is bearish, as seen by value motion, with the pair extending its downtrend contained in the Ichimoku Cloud (Kumo). Sellers are eyeing the subsequent help at Senkou Span B at 153.76.

On additional weak point, the subsequent help could be the 200-day Easy Transferring Common (SMA) at 152.83

Alternatively, if patrons obtain a each day shut above 155.00, search for additional upside. Key resistance is discovered on the Senkow Span A at 155.76.

Japanese Yen PRICE As we speak

The desk beneath reveals the proportion change of Japanese Yen (JPY) towards listed main currencies in the present day. Japanese Yen was the strongest towards the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.69% | 0.16% | -0.48% | -0.48% | 0.70% | 0.30% | -0.34% | |

| EUR | -0.69% | -0.21% | 0.08% | -0.09% | 0.39% | 0.70% | 0.06% | |

| GBP | -0.16% | 0.21% | -0.86% | 0.12% | 0.61% | 0.91% | 0.28% | |

| JPY | 0.48% | -0.08% | 0.86% | -0.12% | 1.32% | 1.54% | 0.67% | |

| CAD | 0.48% | 0.09% | -0.12% | 0.12% | 0.19% | 0.78% | 0.15% | |

| AUD | -0.70% | -0.39% | -0.61% | -1.32% | -0.19% | 0.30% | -0.43% | |

| NZD | -0.30% | -0.70% | -0.91% | -1.54% | -0.78% | -0.30% | -0.63% | |

| CHF | 0.34% | -0.06% | -0.28% | -0.67% | -0.15% | 0.43% | 0.63% |

The warmth map reveals proportion modifications of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, in case you choose the Japanese Yen from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will symbolize JPY (base)/USD (quote).